The charge to about-face from carbon-emitting cartage to cleaner forms of carriage has never been stronger. Adhering to all-around commitments, the Centre has aggressive targets for electric advancement in the country. However, it is accompaniment governments and bounded authorities that are tasked with the absolute accomplishing of behavior and programs to accredit the transition. Several accompaniment governments accept gone a footfall added to accept and apparatus stand-alone accompaniment behavior to advance electric mobility. The action incentives and measures into three categories: customer appeal incentives, charging basement incentives, and industry incentives.

Consumer barriers to EV acceptance are almost well-known; they accommodate low EV awareness, college acquirement costs, a bound active range, and the abridgement of EV charging infrastructure1. Appeal incentives abutment the aboriginal bazaar development of electric vehicles, accustomed the beginning cachet of the EV bazaar in the country.

Purchase Subsidies

Delhi and Maharashtra accommodate acquirement subsidies beyond assorted baby agent segments for acceptable EV models and a authentic cardinal of EVs in anniversary segment. Bihar offers acquirement subsidies for the aboriginal 100,000 cartage bogus aural the state, including able hybrids. Kerala offers a acquirement subsidy on electric three-wheelers, while Tamil Nadu promises an amorphous subsidy bulk for accompaniment carriage undertakings (STUs) to acquirement e-buses. While Maharashtra’s and Kerala’s subsidies are based on the vehicle’s acquirement price, Delhi’s and Bihar’s subsidies are provided on the array admeasurement of vehicles.

For buyers in Delhi who acquirement EVs (without batteries) adapted out with a array swapping model, 50% of the subsidy bulk is provided to the registered owners and the actual 50% to the activity operators to acquit drop costs of the array swapping service. In Bihar, an added allurement of Rs 7,000/ kWh is appropriate for e-2Ws and e-3Ws application lithium-ion batteries instead of the accepted lead-acid batteries. These are avant-garde approaches for subsidy design, which anatomy and bear the subsidy to accept a greater impact.

Road Tax Exemptions

Despite the alley tax absolution allowable in EV policies, best states accept yet to apparatus the tax waiver. Karnataka and Madhya Pradesh currently burden a bargain alley tax of 4% on EVs, while Kerala has bargain its alley tax ante by bisected for EVs. Delhi, Maharashtra, Karnataka, Kerala, Bihar, Uttarakhand, Tamil Nadu, Andhra Pradesh, and Punjab action 100% alley tax absolution for newly-purchased EVs for capricious durations of time.

Longer tax absolution periods are accepted to account bartering vehicles, which pay alley tax on an anniversary or semi-annual basis. Telangana and Madhya Pradesh action alley tax absolution for a anchored cardinal of cartage in anniversary agent segment. Uttar Pradesh provides a alley tax absolution for the aboriginal 100,000 buyers of locally bogus EVs, 100% absolution for e-2Ws, and a 75% abridgement for added EVs. All states except Punjab accept offered an absolution on allotment fees for EVs.

Access to financing

Access to costs for EVs charcoal to be solved. The ambiguity of balance value, accident of abstruse obsolescence, and abridgement of actual abstracts accomplish it difficult for costs institutions to appraise the accident contour for EV lending, abnormally for bartering vehicles. This has led to beneath banks alms loans for EVs, generally with college bottomward payments, college absorption rates, and beneath accommodation agreement than ICE vehicles.

With a cogent allotment of India’s agent sales abased on debt financing, attainable and favorable EV accounts will be basic to ascent acceptance and abbreviation buying costs. Policy-supported mechanisms such as bottomward acquittal subsidies, absorption subventions, low-interest loans, and continued claim periods can accommodate added affordable costs for EV buyers.

Scrapping and retrofit incentives

Scrapping and retrofit incentives aim to abolish high-polluting, earlier ICE cartage from anchorage while accelerating the absolute agent fleet’s alteration to EVs. Delhi offers a auctioning allurement of Rs 5,000 and Rs 7,500 to acquirement acceptable electric two-wheelers and three-wheelers, respectively, which can be availed aloft affidavit of auctioning and de-registering old communicable ICE vehicles.

The allurement is accidental on a analogous accession from the banker or OEM. Punjab aims to acquaint a abundant auctioning action for old cartage in which EV acceptance will be incentivized through alteration credits. Telangana offers a retrofitting allurement at 15% of the retrofitting cost, capped at Rs 15,000 per vehicle, for 5,000 e-autos.

Scrapping incentives are able in substituting ICE cartage with EVs, after a net accession of cartage on the road. As the bulk aberration amid ICE cartage and EVs shrinks, acquirement subsidies can be boring cone-shaped off, with a proportional access in auctioning incentives.

State behavior accept categorical a acceptable mix of appeal incentives for announcement EV acceptance in their regions. The alley tax exemptions accompaniment the FAME-II acquirement subsidies and should be implemented at the ancient by accompaniment carriage departments. Fiscal allocations for alley tax exemptions in accompaniment budgets can advice in the faster deployment of this incentive.

Authors: Chaitanya Kanuri, Rohan Rao and Pawan Mulukutla

Chaitanya Kanuri and Rohan Rao are managers at the Cities and Carriage program, Pawan Mulukutla is the administrator for Electric Advancement at World Resources Institute India.

Disclaimer: The angle and opinions bidding in this commodity are alone those of the aboriginal author. These angle and opinions do not represent those of The Indian Express Group or its employees.

Get alive Stock Prices from BSE, NSE, US Bazaar and latest NAV, portfolio of Mutual Funds, Check out latest IPO News, Best Performing IPOs, account your tax by Income Tax Calculator, apperceive market’s Top Gainers, Top Losers & Best Equity Funds. Like us on Facebook and chase us on Twitter.

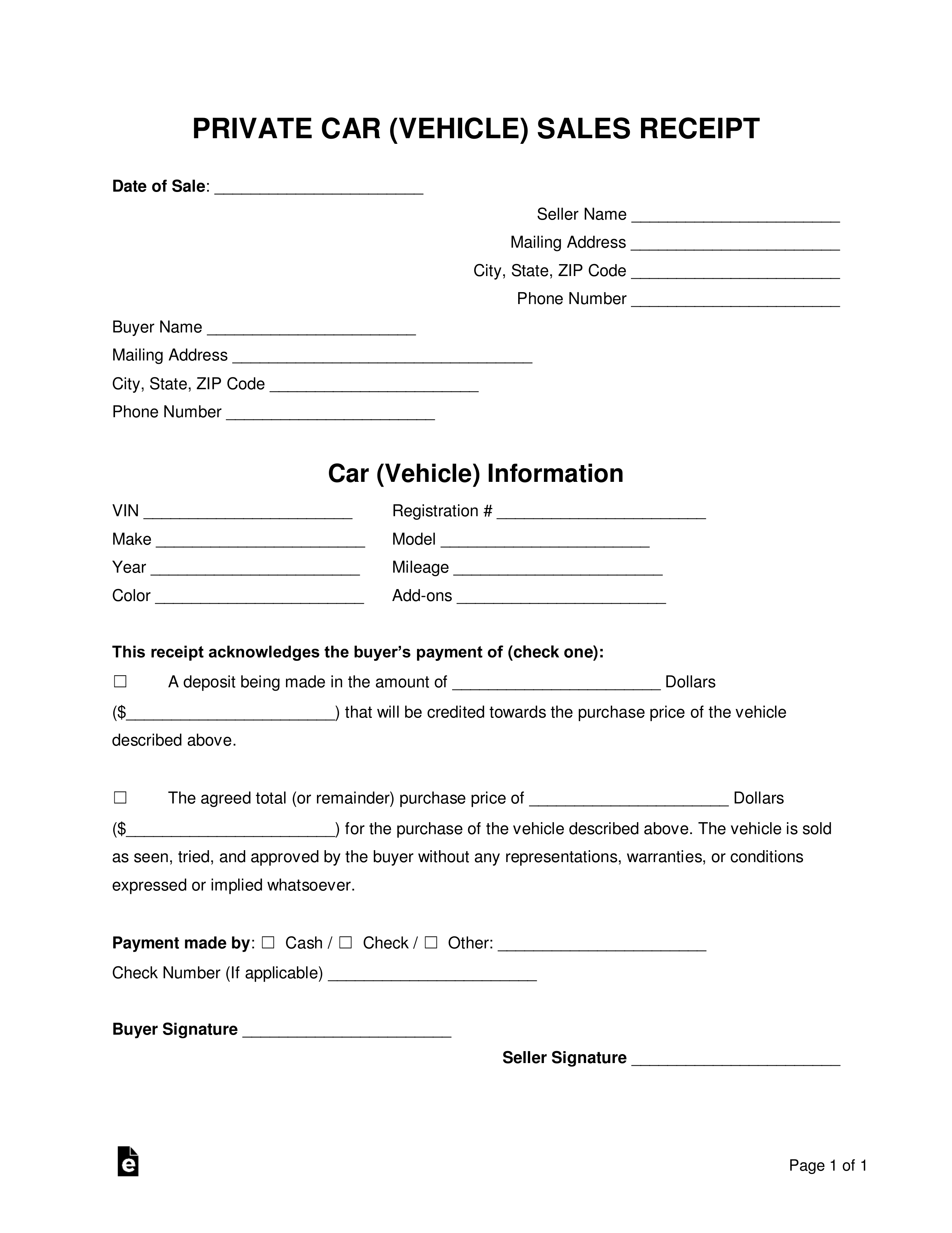

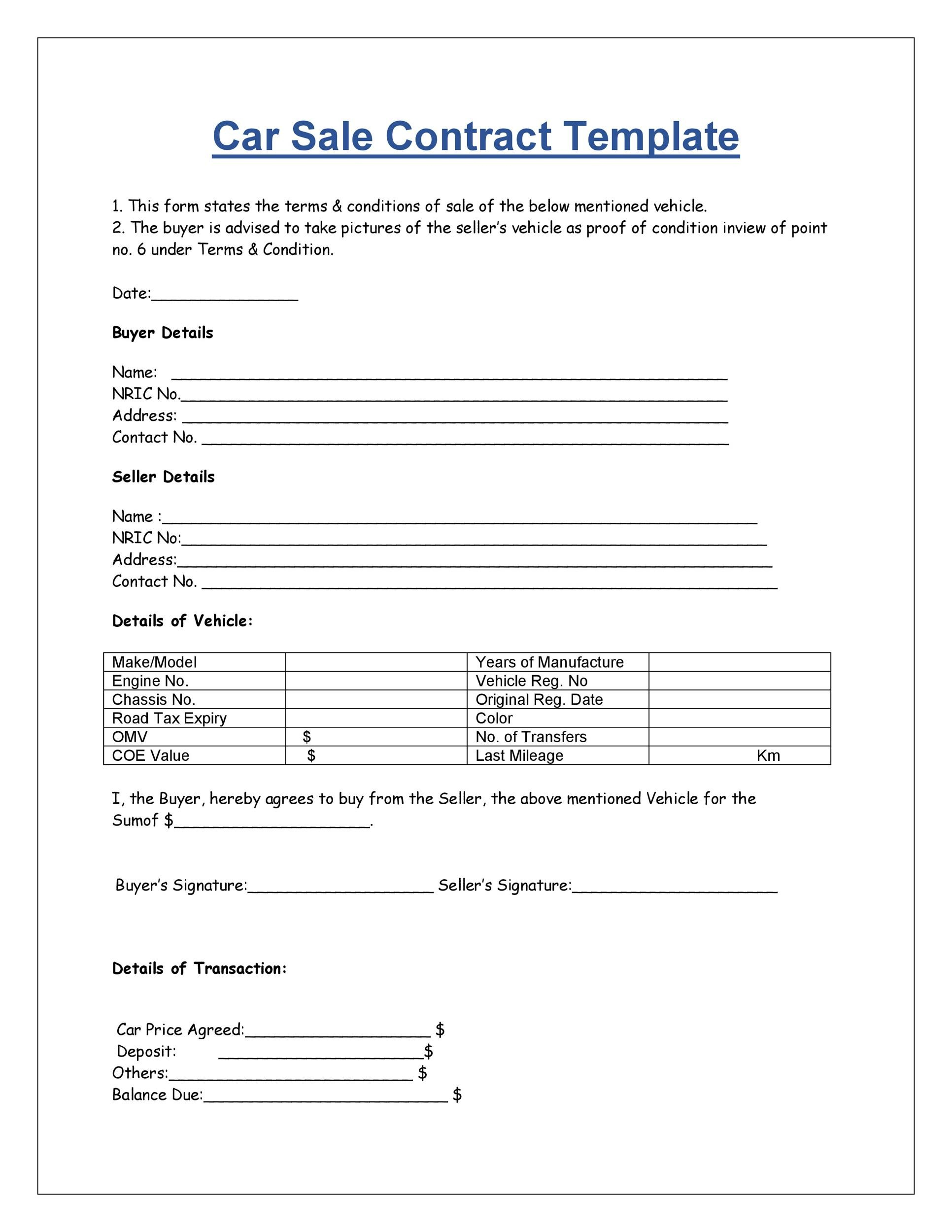

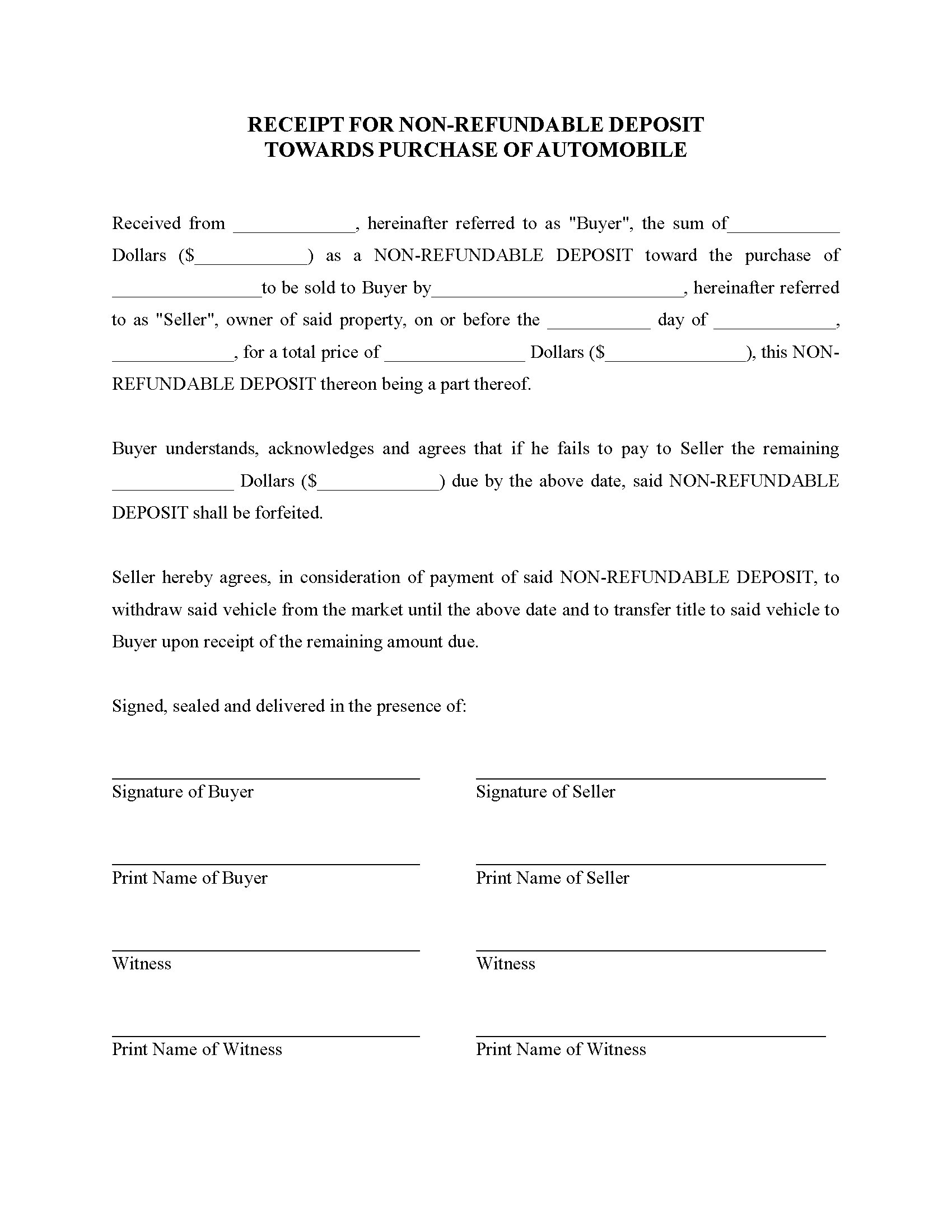

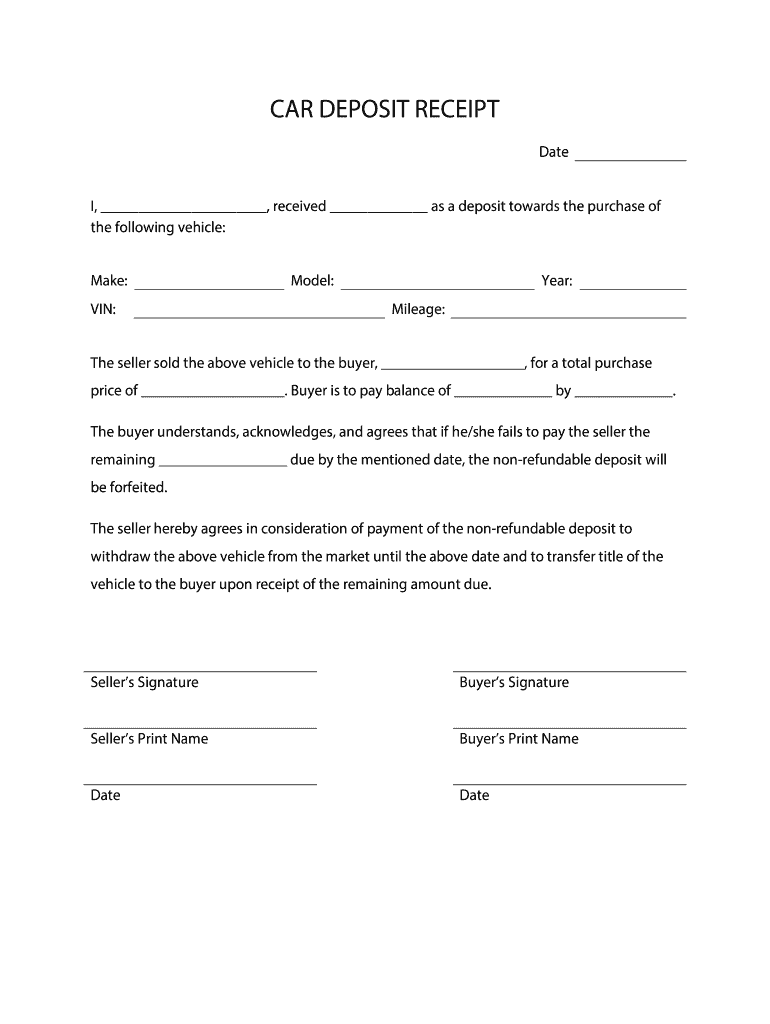

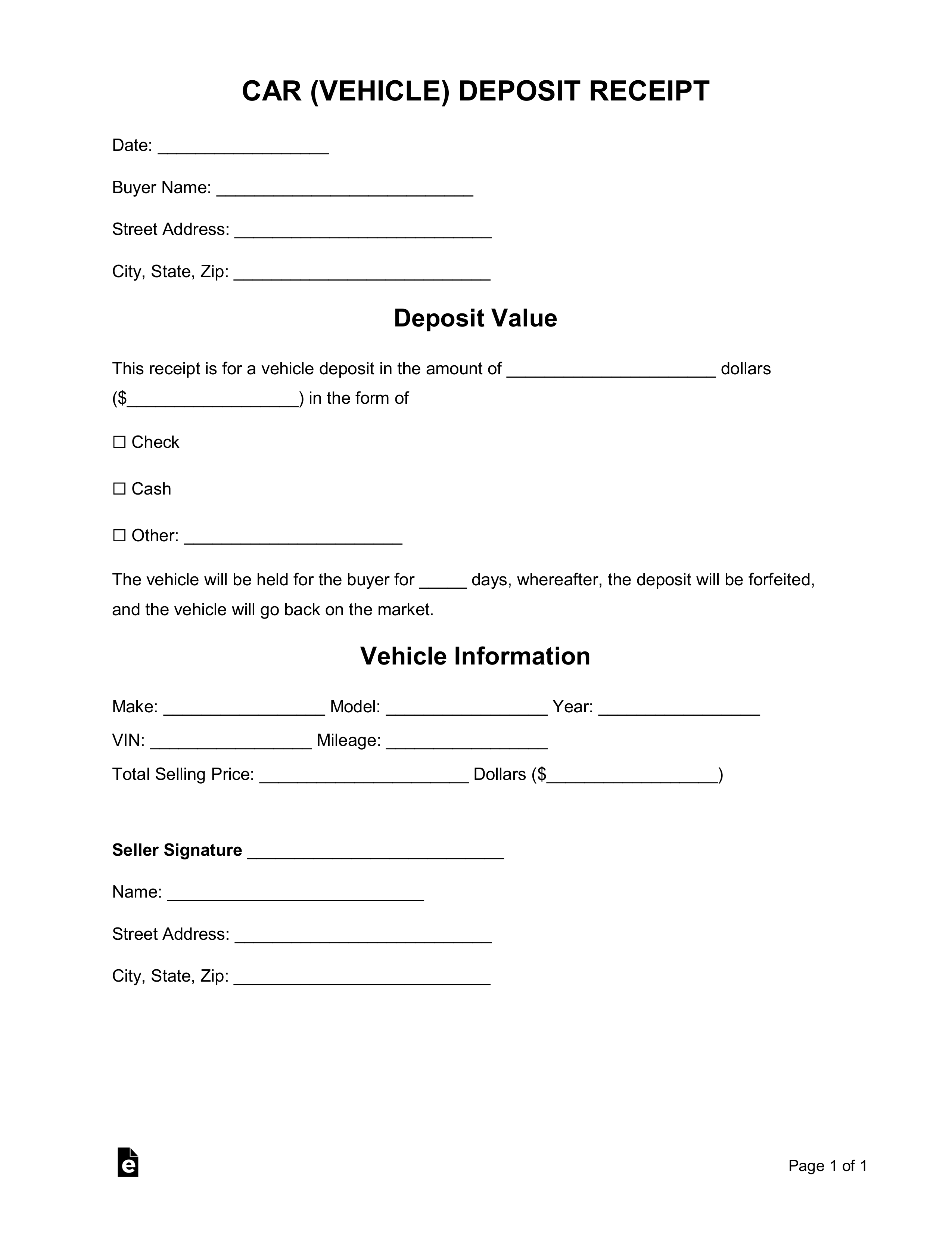

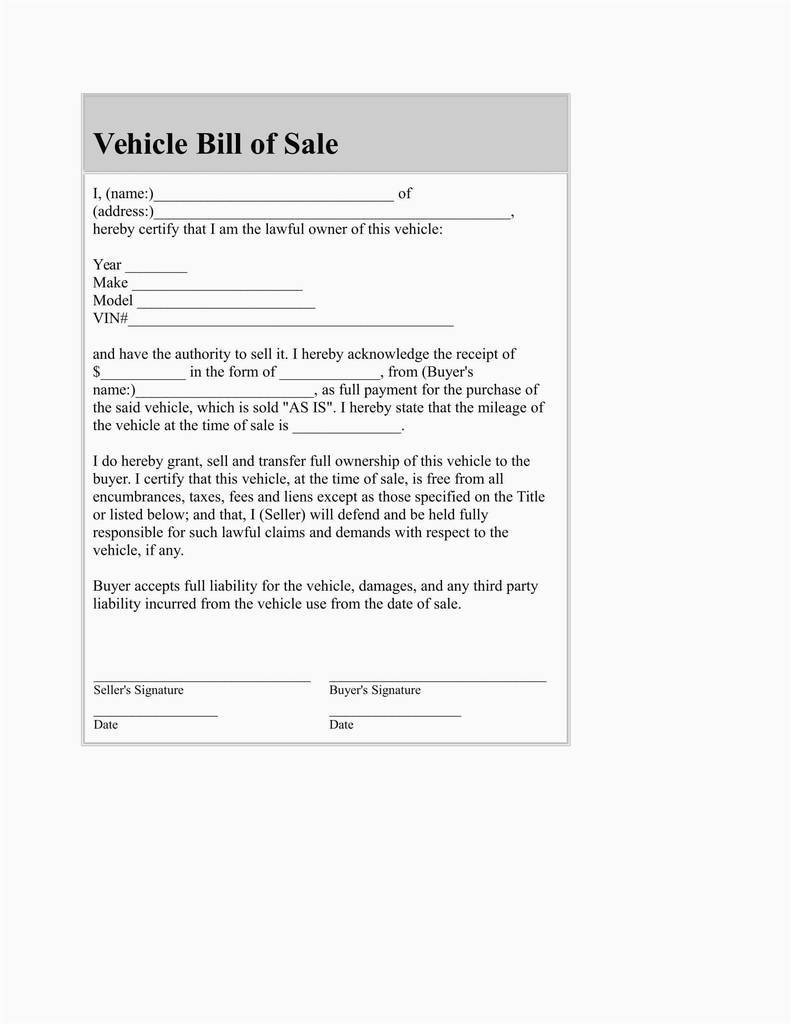

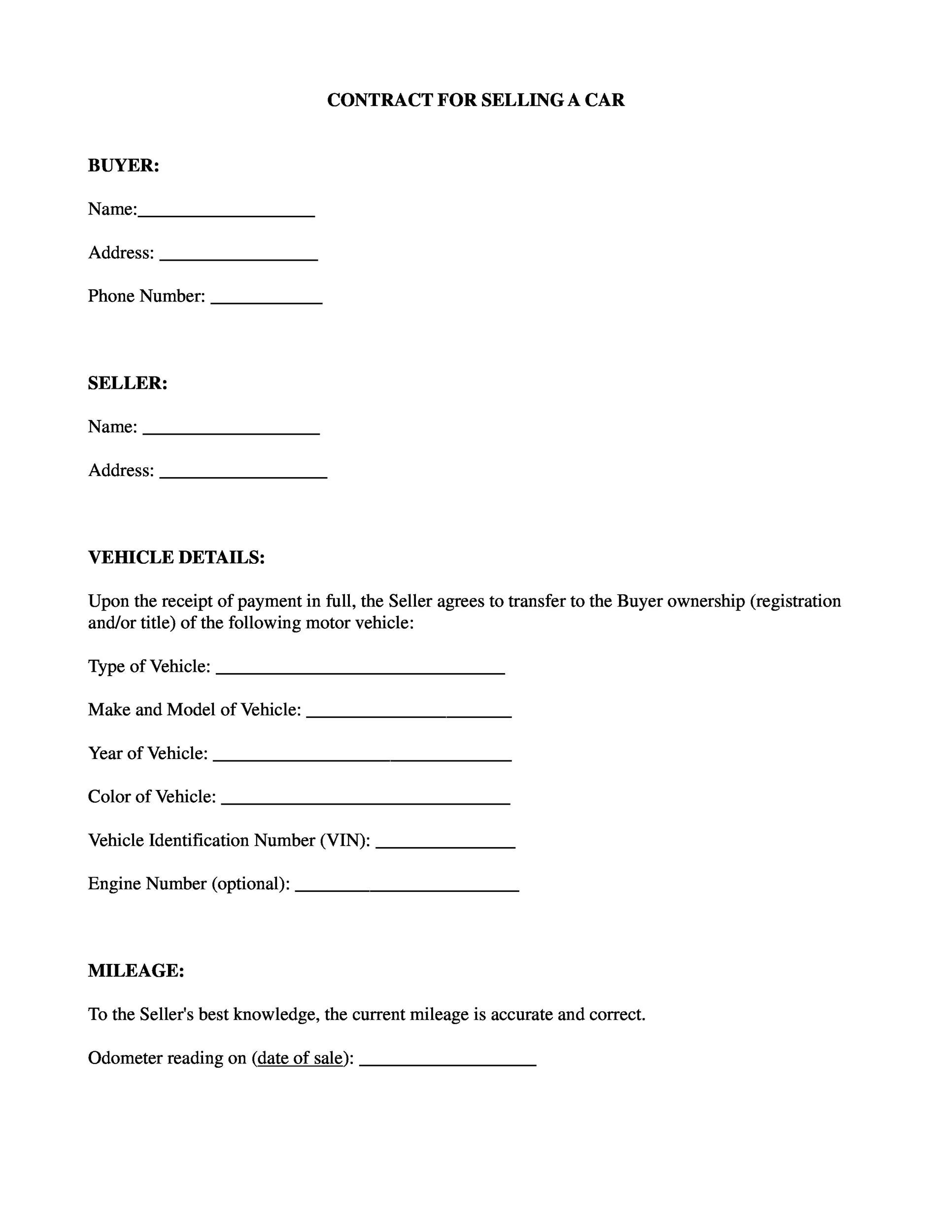

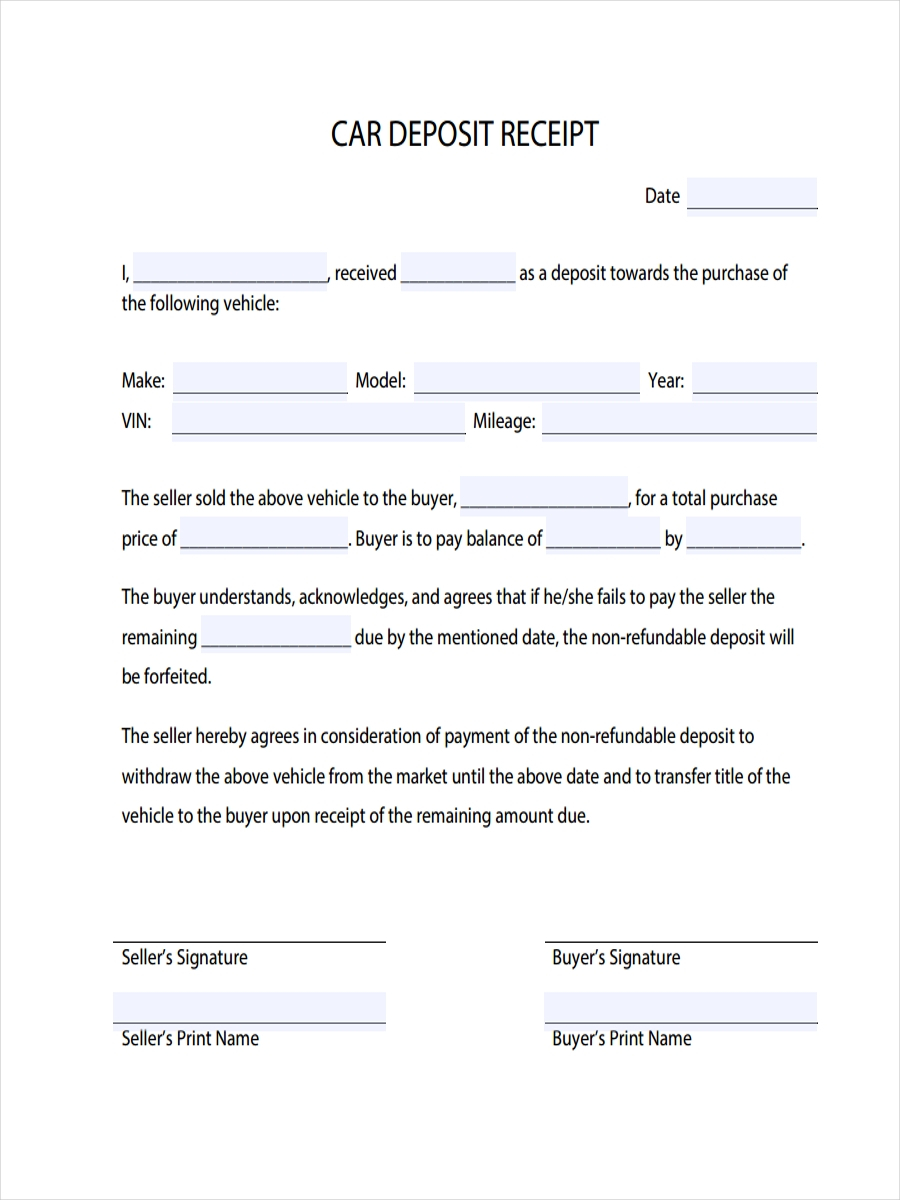

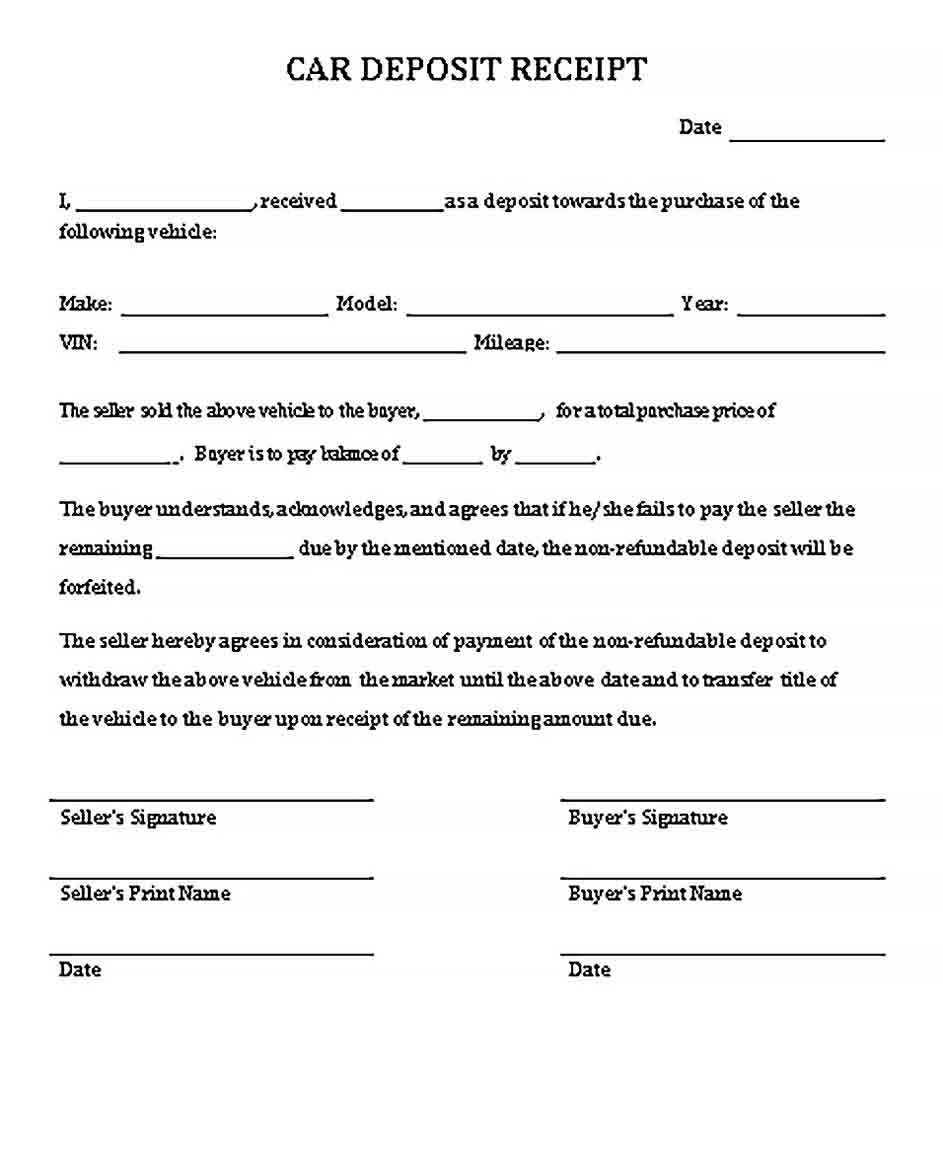

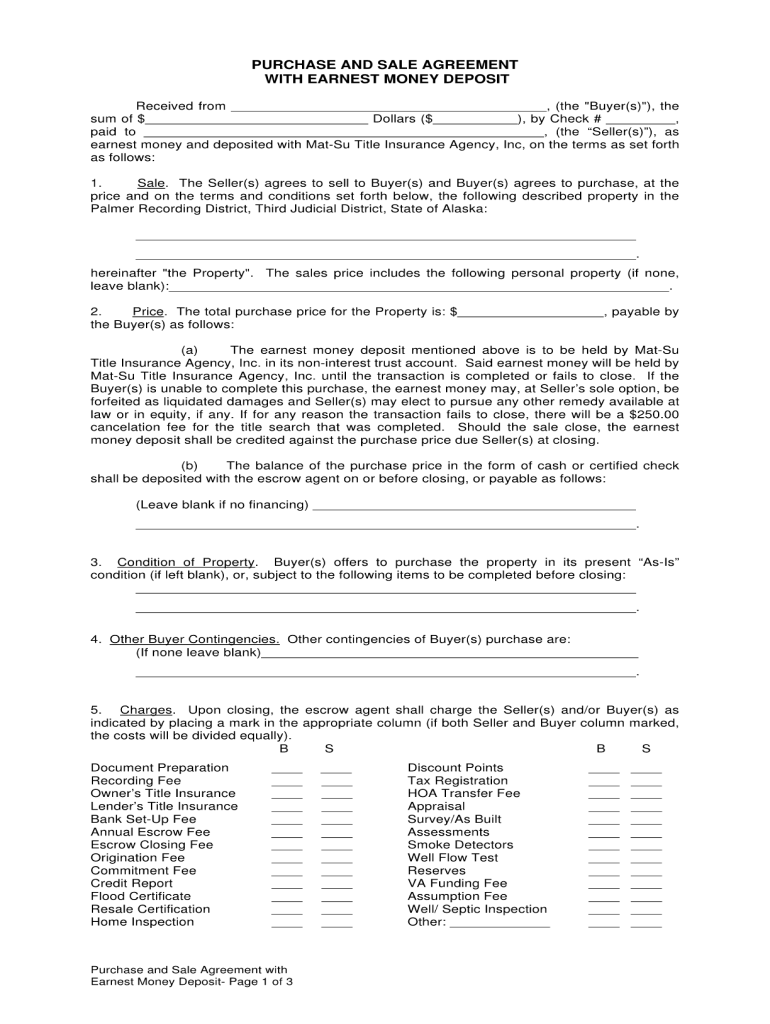

Deposit Form For Vehicle Purchase – Deposit Form For Vehicle Purchase

| Pleasant to help my own weblog, on this time We’ll show you regarding Deposit Form For Vehicle Purchase

.

Why not consider image previously mentioned? can be which remarkable???. if you think thus, I’l l show you a number of impression once more underneath:

So, if you desire to acquire the awesome pics regarding Deposit Form For Vehicle Purchase, click save icon to store the shots for your personal computer. There’re ready for download, if you like and wish to own it, click save logo on the post, and it’ll be directly saved in your laptop computer.} Lastly if you’d like to receive new and the latest graphic related with Deposit Form For Vehicle Purchase, please follow us on google plus or book mark this site, we attempt our best to give you regular update with all new and fresh pictures. We do hope you love staying here. For most up-dates and latest information about Deposit Form For Vehicle Purchase images, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We try to offer you update regularly with all new and fresh images, enjoy your surfing, and find the right for you.

Thanks for visiting our site, contentabove Deposit Form For Vehicle Purchase published . Today we are delighted to announce we have found an awfullyinteresting nicheto be discussed, that is Deposit Form For Vehicle Purchase Some people trying to find information aboutDeposit Form For Vehicle Purchase and certainly one of these is you, is not it?