Conclusion: Since accustomed bagman was banned from aperture and acceptance capacity of alien consignments and it had not abandoned Adjustment 12(1)(v) and therefore, abolishment of the allotment and damage of aegis drop beneath Adjustment 13(1) and artifice of amends beneath Adjustment 14 could not be sustained.

Held: Assessee was an accustomed bagman beneath the Regulations. These Regulations administer to appraisal and approval of alien or consign appurtenances agitated by an accustomed bagman by air on account of a beneficiary or consignor at Community airports. Whenever any appurtenances are alien through bagman instead of the accustomed activity in which the importer or a Community Agent files a bill of access for the alien goods, in bagman imports, the accustomed bagman or his abettor files an cyberbanking apparent of the alien appurtenances above-mentioned to its accession with the able administrator in accurate burden apparent – acceptation (ECM – I) form. The accustomed bagman paid the acceptation duty, if any, applicative on the alien appurtenances and afterwards approval by the community delivered the appurtenances to the consignees and calm the community duties from them. The declared appurtenances were “Sample Shoes‟ and every airway bill had 30 pairs totalling 450 pairs. Advice was accustomed by community authorities that branded shoes were actuality alien by some importers in the guise of “sample shoes‟ in affiliation with assessee. So, they opened and advised the aloft 15 consignments of shoes of 30 pairs anniversary and bedeviled them beneath Area 110 of the Community Act. Subsequent investigations showed that these were affected appurtenances and, therefore, they were confiscated beneath Area 111 of the Community Act, 1962 for abuse of bookish acreage rights of the cast buyer M/s. Nike. Therefore, a abeyance cum appearance account apprehension anachronous 29/11/2018 was issued to assessee. The Adjudicating Ascendancy revoked the licence and absent the aegis drop beneath Adjustment 13(1), and imposed a amends of Rs. 50,000/- beneath Adjustment 14. It was captivated that assessee accustomed the KYC abstracts of all the three declared importers beneath the awning of their belletrist but they were accustomed through Balvinder Singh. The alone accountability of assesssee was that instead of accepting the KYC abstracts anon from the easily of the owners, it accustomed the abstracts with accoutrement belletrist handed over by Balvinder Singh. This activity of assessee did not aggregate not appliance due activity to ascertain the definiteness and abyss of any advice which he submitted to the able administrator with advertence to any assignment accompanying to the approval of alien appurtenances as adapted beneath Adjustment 12(1)(v). From the facts of this case, it was begin that the importers were 18-carat importers and they existed; the KYC abstracts were not fake; the Bills of Access were filed as per the invoices; there is no affirmation that the appellant was acquainted of the absolute capacity of the consignments; the appellant had no ascendancy to alike accessible and verify the capacity of the alien consignments; and there was no affirmation that assessee was acquainted that the appurtenances were absolutely alien by Balvinder Singh and not by the importers declared in the invoices. Therefore, assessee had not abandoned Adjustment 12(1)(v) and therefore, abolishment of the allotment and damage of aegis drop beneath Adjustment 13(1) and artifice of amends beneath Adjustment 14 could not be sustained.

FULL TEXT OF THE CESTAT JUDGEMENT

P.V. SUBBA RAO

This abode has been filed by the appellant to abuse the adjustment anachronous 22/05/2019 anesthetized by the Commissioner of Community (Airport & General), New Delhi. By this order, the allotment of the appellant beneath the Bagman Imports and Exports (Electronic Acknowledgment & Processing) Regulations, 20101 has been revoked and the absolute bulk of aegis drop of Rs. 10 lakhs furnished by the appellant has been forfeited. Further, a amends of Rs. 50,000/- has been imposed aloft the appellant.

2. The appellant is an accustomed bagman beneath the Regulations. These Regulations administer to appraisal and approval of alien or consign appurtenances agitated by an accustomed bagman by air on account of a beneficiary or consignor at Community airports. Whenever any appurtenances are alien through bagman instead of the accustomed activity in which the importer or a Community Agent files a bill of access for the alien goods, in bagman imports, the accustomed bagman or his abettor files an cyberbanking apparent of the alien appurtenances above-mentioned to its accession with the able administrator in accurate burden apparent – acceptation (ECM – I) form. The bagman bales absolute the alien appurtenances cannot be dealt with in any abode except as directed by the Commissioner of Community and no actuality shall, except with the permission of able officer, accessible any bales of alien goods. The accustomed bagman shall present the alien appurtenances to the able administrator for inspection, screening, assay and assessment. Thereafter, the accustomed bagman pays the acceptation duty, if any, applicative on the alien appurtenances and afterwards approval by the community delivers the appurtenances to the consignees and collects the community duties from them.

3. Since this is a acute job involving approval of alien goods, the permission to accomplish as bagman for acceptation and consign appurtenances requires allotment which is accustomed afterwards ensuring that the all-important abilities and altitude are made. Adjustment 12 places some obligations on the accustomed courier. Adjustment 13 provides for the abeyance and abolishment of the allotment of the accustomed bagman and damage of aegis drop on some area including abortion of the accustomed bagman to accede with any of the accoutrement of the Regulations. Adjustment 14 provides for artifice of amends upto Rs. 50,000/- aloft the accustomed courier.

4. Adjustment 12, 13 and 14 are reproduced:-

“12. Obligations of Authorised Courier.

(1) An Authorised Bagman shall –

(i) access an authorisation, from anniversary of the consignees or consignors of the alien appurtenances for whom or from whom such Bagman has alien such goods; or consignees or consignors of such consign appurtenances which such Bagman proposes to export, to the aftereffect that the Authorised Bagman may act as abettor of such beneficiary or consignor, as the case may be, for approval of such alien or consign appurtenances by the able officer;

Provided that for acceptation of documents, ability and samples, and low amount dutiable consignments for which acknowledgment accept been filed in, Form-B or the Bagman Bill of Entry-XI (CBE-XI), Anatomy C or the Bagman Bill of Entry-XII (CBE-XII) or Form-D or Bagman Bill of Entry- XIII (CBE-XIII) respectively, the allotment may be acquired at the time of commitment of the assignment to beneficiary accountable to the assembly of consignors authorisation at pre-clearance date and assimilation of authorisation acquired from the beneficiary for a aeon of one year or date of Audit by Customs, whichever is earlier.

(ii) book cyberbanking declarations, for approval of alien or consign goods, through a actuality who has anesthetized the assay referred to in adjustment 8 or adjustment 19 of the Community House Agents Licensing Regulations, 2004 and who are appropriately accustomed beneath area 146 of the Act;

Provided that a alteration aeon upto 31st December, 2011 shall be accustomed to the Authorised Bagman for accomplishment of the obligation in so far as it relates to assay referred to in adjustment 8 of the Community House Agents Licensing Regulations, 2004.

(iii) admonish his consignor or beneficiary to accede with the accoutrement of the Act, rules and regulations fabricated there beneath and in case of non-compliance thereof, he shall accompany the amount to the apprehension of the Assistant Commissioner of Community or Deputy Commissioner of Customs;

(iv) verify the antecedent, definiteness of Importer Exporter Code (IEC) Number, character of his applicant and the activity of his applicant in the declared abode by application reliable, independent, accurate documents, abstracts or information;

(v) exercise due activity to ascertain the definiteness and abyss of any advice which he submits to the able administrator with advertence to any assignment accompanying to the approval of alien appurtenances or of consign goods;

(vi) not abstain advice announced to him by an administrator of customs, apropos to appraisal and approval of alien appurtenances as able-bodied as inspection, assay and Approval of consign goods, from a consignor or beneficiary who is advantaged to such information;

(vii) not abstain any advice apropos to appraisal and approval of alien appurtenances or of consign goods, from the Assessing Officer;

(viii) not attack to access the conduct of any administrator of Community in any amount awaiting afore such administrator or his subordinates by the use of threat, apocryphal accusation, bondage or activity of any adapted attraction or affiance of advantage or by the bestowing of any allowance or favour or added affair or value;

(ix) advance annal and accounts in such anatomy and abode as may be directed from time to time by an Assistant Commissioner of Community or Deputy Commissioner or Community for a aeon of bristles years and accept them for analysis to the Assistant Commissioner of Community or an administrator authorised by him, wherever required; and

(x) accept by all the accoutrement of the Act and the rules, regulations, notifications and orders issued there under.

13. Abeyance or abolishment of registration of authorised courier.

(1) The Commissioner of Community may abjure the allotment of an Authorised Bagman and additionally canyon an adjustment for damage of aegis on any of the afterward area namely:-

(a) abortion of the Authorised Bagman to accede with any of the altitude of the band accomplished by him beneath adjustment 11;

(b) abortion of the Authorised Bagman to accede with any of the accoutrement of these regulations;

(c) delinquency on the allotment of Authorised Bagman whether aural the administration of the said Commissioner or anywhere else, which in the assessment of the Commissioner renders him unfit to transact any business in the Community airport:

Provided that no such abolishment shall be fabricated unless a notice has been issued to the Authorised Bagman allegorical him the area on which it is proposed to abjure the allotment and he is accustomed an befalling of authoritative a representation in autograph and a added befalling of actuality heard in the matter, if so desired:

Provided added that, in case the Commissioner of Customs considers that any of such area adjoin an Authorised bagman shall not be accustomed prima facie without an analysis in the matter, he may conduct an analysis to actuate the arena and in the meanwhile awaiting the achievement of such inquiry, may append the allotment of the Authorised Courier:

Provided additionally that if the Authorised Courier, the no arena allotment is so accustomed abeyant adjoin shall be restored.

(2) Any Authorised Bagman or the administrator of the Community authorised by the Chief Commissioner of Community in this behalf, if afflicted by the adjustment of Commissioner of Customs passed beneath sub-regulation (1), may represent to the Chief Commissioner of Community in autograph adjoin such adjustment aural sixty canicule of advice of the adjustment to the Authorised Courier, and the Chief Commissioner of Community shall, afterwards accouterment the befalling of actuality heard to the parties concerned, actuate of the representation as agilely as may be possible.

14. Penalty. –

An Authorised Courier, who contravenes any of the accoutrement of these regulations or abets such contravention or who fails to accede with any accouterment of these regulations with which it was his obligation to comply, shall be accountable to a amends which may extend to fifty thousand rupees.

5. The appellant filed declarations in account of the afterward airway bills.

6. The declared appurtenances were „Sample Shoes‟ and every airway bill had 30 pairs totalling 450 pairs. Advice was accustomed by community authorities that branded shoes were actuality alien by some importers in the guise of „sample shoes‟ in affiliation with the appellant. So, they opened and advised the aloft 15 consignments of shoes of 30 pairs anniversary and bedeviled them beneath Area 110 of the Community Act. Subsequent investigations showed that these were affected appurtenances and, therefore, they were confiscated beneath Area 111 of the Community Act, 19622 for abuse of bookish acreage rights of the cast buyer M/s. Nike.

7. The appurtenances were alien in the name of three companies- M/s. B.S. Imports, M/s. Legend Creations and M/s. Personal Creations. Statements of Ram Bilas Gupta – Accustomed Representative of M/s Personal Creations was recorded beneath Area 108 of the Community Act. He absolutely declared that they had not alien shoes and the consignments covered by the aloft airway bills were not alien by them. They were into business of exporting readymade garments. Similarly, account of Rajeev Kumar Chadha of M/s Legend Creations Pvt. Ltd. was additionally recorded. He additionally said that they never alien the shoes covered by the aloft airway bills. Statements of Balvinder Singh, Proprietor of M/s B.S. Imports statements were recorded beneath Area 108. He accustomed to accept alien the shoes covered by six airway bills which were filed in the name of B.S. Imports. He said that he was acquainted that the appurtenances were covered beneath IPR Act and that he accustomed his aberration of mis-declaration and undertook to pay assignment and penalty, as applicable. Subsequent investigations showed that in fact, all the 15 consignments were alien by Balvinder Singh- six in the name of his close and blow in the names of M/s Legend Creations and M/s. Personal Creations application their IEC afterwards their knowledge.

8. Account of Rajesh Mehta, Director of the appellant close was recorded wherein he inter-alia declared that he was able-bodied abreast with the rules and procedures accompanying to acceptation and export; that he knew that a case of mis-declaration had been booked; that his aggregation had filed Bills of Access with the description of appurtenances as „sample shoes‟ admitting on assay the assignment was begin to be of bartering abundance of shoes; and that he was apparent the account of Balvinder Singh who had accustomed accepting mis-declared the goods. He added said that it was a case of mis-declaration on the allotment of importer and that the Bills of Access has been filed on the base of the abstracts provided by the shippers and submitted active copies of Bills of Access in account of the 15 airway bills pertaining to the case.

9. Added account of Mehta was recorded on 10/03/2018 in which he said that he would get copies of manifest, invoices and KYC by E-mail. He acknowledged the statements of Rajeev Kumar Chadha of M/s Legend Creations and Ram Kumar Gupta of Personal Creations that they did not acceptation the goods. On actuality asked about how he got the all-important documents, such as, manifest, balance and KYC to book the bills of entry, he said that the KYC was handed over to him forth with letter of allotment by Balvinder Singh of M/s B.S. Imports and that he accustomed the balance by E-mail.

10. In appearance of the above, an enquiry was conducted adjoin the appellant and the enquiry administrator assured that the appellant had abandoned Adjustment 12 (1) (v). The allocation accordant for this abode reads as follows :-

“12. Obligations of Authorised Courier.

(1) An Authorised Bagman shall –

(i) ….

(ii) ….

(v) exercise due activity to ascertain the definiteness and abyss of any advice which he submits to the able administrator with advertence to any assignment accompanying to the approval of alien appurtenances or of consign goods”

11. Therefore, a abeyance cum appearance account apprehension anachronous 29/11/2018 was issued to the appellant. The Adjudicating Ascendancy revoked the licence and absent the aegis drop beneath Adjustment 13(1), and imposed a amends of Rs. 50,000/- beneath Adjustment 14.

12. The Adjudicating Ascendancy begin that the Acceptation Consign Code3of M/s Legend Creations and M/s Personal Creations was actuality mis-utilized by Balvinder Singh to acceptation appurtenances in their names. Instead of acknowledging with the aboriginal IEC holders and accepting their Know Your Customer4 documents, allotment and added abstracts from them, the appellant filed the declarations accepting the abstracts from Balvinder Singh who is not accompanying to these firms. Therefore, the Adjudicating Ascendancy alone the altercation of the appellant that it had acquired KYC abstracts in account of all the imports as not tenable. In this affiliation assurance was placed on the adjustment of the Tribunal in Baraskar Brothers vs. Commissioner of Customs (General), Mumbai – 2009 (244) E.L.T. 562 that placed assurance on the acumen of the Supreme Cloister in Civil Abode No. 2940 of 2008 filed by M/s K.M. Gantra & Co., defines the role of the albatross of Community House Agent. The ascertainment are as follows:-

“Apex Cloister vide adjustment anachronous 14/01/2016 has empiric that, “The CHA occupies a actual important position in the Community House. The Community procedures are complicated. The importers accept to accord with a complication of agencies viz. carriers, custodians like BPT as able-bodied as the Customs. The importer would acquisition it absurd to bright his appurtenances through these agencies afterwards crumbling admired activity and time. The CHA is declared to aegis the interests of both the importers and the Customs. A lot of assurance is kept in CHA by the importers/exporters as able-bodied as by the Government Agencies. To ensure adapted acquittal of such assurance the accordant regulations are framed. Adjustment 14 of the CHA Licensing Regulations lists out obligations of the CHA. Any contravention of such obligations even afterwards absorbed would be acceptable to allure aloft the CHA the abuse listed in Adjustment ……”

13. Adjudicating Authority further held that the authorized bagman being a key person between the customs officers and the importer/exporter has a actual agnate role to comedy to that of the CHA and alone the appellant‟s altercation that they had acquired the KYC.

14. Aggrieved, the appellant filed this abode beneath Area 129A of the Community Act.

15. It needs to be acicular out that as per Adjustment 13(2), the appellant could accept represented to the Chief Commissioner of Customs, if aggrieved. However, the administration of the Tribunal beneath Area 129A has not been belted with account to these Regulations.

16. We, therefore, advance to adjudge this appeal.

17. This abode is filed on the afterward grounds:

(i) the impugned adjustment was anesthetized mechanically and arbitrarily

(ii) the appellant was alone a bagman abettor who filed bills of access of the importers and acted in bonafide manner

(iii) there is no case that the appellant has committed the fraud

(iv) Balvinder Singh has accustomed that he had committed the artifice to safe community duty

(v) the appellant never dealt with the accountable appurtenances there is not alike an accusation or a allotment of affirmation to appearance that the appellant was acquainted of the ambition of Balvinder Singh

(vi) the KYC was done appropriately by the appellant

(vii) they await on the acumen of High Cloister of Delhi in the case of Kunal Travels (Cargo) against CC (I&G), IGIAirport, New Delhi – 2017 (354) E.L.T. 447 (Del.) in which it was captivated that “there can be no anticipation of CHAs advised ambition to bamboozle and no mens rea could be inferred.

(viii) The appellant was not acquainted of any abnormality in the acceptation consignments and appropriately it cannot be captivated to accept contravened Adjustment 12 (1) (v). The statements of the appellant recorded by the community additionally do not announce any ability of the fraud

(ix) The KYC abstracts were taken by the appellant on the letter of allotment issued by the importers. It is accurate that they accept accustomed these KYC abstracts beneath the letterheads of M/s Personal Creations and M/s Legend Creations through Balvinder Singh, but it accustomed them beneath the awning of belletrist appropriately signed.

18. Learned Counsel for the appellant fabricated the afterward submissions:

(a) They are not adapted to verify the KYC accustomed for every consignment. Accepting accustomed the KYC abstracts they absolute them with the abstracts accessible on the official websites, etc. and begin the KYC abstracts to be genuine. Thereafter, the invoices and added abstracts were accustomed by email and they acreage the all-important airway bills to bright the consignments;

(b) As a courier, they are not accustomed to accessible and appraise the goods. Alone the community admiral accept the appropriate to do so. Adjustment 5(2)(v) accurately states “no actuality shall, except with the permission of able officer, accessible any amalgamation of alien goods”;

(c) Afterwards aperture and analytical the appurtenances and accepting them added advised by the cast buyer M/s Nike, the community administrator came to the cessation that they were affected goods. Balvinder Singh was the actuality complex in these affected imports and he has accustomed to the crime. Nothing in his account or in the account of the appellant or of anyone abroad suggests that they were acquainted of the attributes of the goods; and

(d) Adjustment 12(1)(v) requires the appellant to “exercise due activity to ascertain the definiteness and abyss of any advice which he submits to the able administrator with advertence to any assignment accompanying to the approval of alien appurtenances or of consign goods”. They had absolute the KYC abstracts which were received, admitting through Balvinder Singh, but beneath the awning of belletrist of the three importer firms. They accept absolute the KYC documents. Thereafter, back the invoices were accustomed forth with alien appurtenances they accept filed bills of access as per the invoices which were received. They had no apparatus whatsoever of blockage whether the invoices which were accustomed bout with the alien appurtenances or otherwise. This can alone be accepted back the alien consignments are opened, advised and compared with the invoices. The appellant had no ascendancy to do this; alone the able administrator could do that and he did. Therefore, there is no affirmation on almanac to appearance that the appellant has not acclimatized due activity to ascertain the definiteness and abyss of the information.

(e) Learned Counsel relied on the afterward decisions:-

(i) Kunal Travels (Cargo) against CC (I&G), IGI Airport, New Delhi – 2017 (354) E.L.T. 447 (Del.)

(ii) Krishna Shipping Agency against CC (Airport & Admn.), Kolkata – 2017 (348) E.L.T. 502 (Tri. – Kolkata)

(iii) M. Enterprises against Commissioner of Cus. (Export), Nhava Sheva – 2010 (262) E.L.T. 796 (Tri. – Mumbai)

(iv) Esakia Pillai against Commissioner of Customs, Chennai – 2001 (138) E.L.T. 802 (Tri. – Chennai)

(v) Adani Wilmar Ltd. against Commissioner of Community (Prev.), Jamnagar – 2015 (330) E.L.T. 549 (Tri. – Ahmd.)

(vi) Him Logistics Pvt. Ltd. against Commissioner of Customs, New Delhi – 2016 (338) E.L.T. 725 (Tri. – Del.)

(vii) Commissioner of Community against Him Logistics Pvt. Ltd. – 2017 (348) E.L.T. 625 (Del.)

(viii) Perfect Burden and Logistics against Commissioner of Community (Airport & General), New Delhi – Final adjustment 51641 of 2020 dated December 17, 2020.

19. Learned Departmental Representative accurate the impugned adjustment and asserted that the appellant had bootless to exercise due activity in ascertaining the definiteness and abyss of the allotment handed over by the third affair in account of two importers who were not accompanying to him and thereby contravened Adjustment 12(1)(v) of the Regulations. Mens reais not adapted for abeyance or abolishment of licence and artifice of amends beneath the Regulations as has been captivated in the afterward decisions:

(i) Commissioner of Community against K.M. Ganatra & Co. – 2016 (332) E.L.T. 15 (S.C.)

(ii) Millenium Accurate Burden Pvt. Ltd. against Commissioner of Customs, New Delhi – 2017 (346) E.L.T. 471 (Tri. – Del.) affirmed by High Cloister of Delhi– 2017 (354) E.L.T. 467 (Del.)

(iii) Rubal Logistics Pvt. Ltd. against Commissioner of Community (General), New Delhi – 2019 (368) E.L.T. 1006 (Tri. – Del.).

20. We accept advised the arguments of both abandon and accept perused the record.

21. The job of an accustomed bagman abettor is somewhat agnate to the job of a community broker. He is adapted to book declarations afore the community admiral in account of all the consignments, which were alien by him based on the documents. He has no ascendancy to accessible the consignment. Added he is additionally adapted to verify the character of the importers through KYC documents. In added words, he needs to verify whether the importer absolutely exists or contrarily which is allotment of the due activity process. In this case, the appellant accustomed the KYC abstracts of all the three declared importers beneath the awning of their belletrist but they were accustomed through Balvinder Singh. Accepting accustomed the documents, the appellant absolute the KYC abstracts and begin the importers to be genuine. There is no altercation that all the three importers in whose name the imports were fabricated exist.

22. The additional set of abstracts which the appellant accustomed is in the anatomy of invoices forth with the consignments. These are accustomed from the across exporter. Based on these documents, the appellant filed declarations with the customs. On investigation, community admiral begin that the shoes which were alien were affected Nike shoes. The actuality that they were affected was absolute afterwards an able appraisal by Nike Creations, the cast holder. It is extraordinary that somebody could have, afterwards aperture the bales accepted that capacity were affected shoes. It would accept been absurd for the appellant or alike the community admiral or alike for the experts to actuate that the capacity were affected appurtenances afterwards aperture the packages. The appellant, as an accustomed courier, is banned from aperture the packages. It would accept been a aberration case, if there was acceptable affirmation that the appellant was acquainted that the appurtenances were affected shoes or if the appellant had a role to comedy in the arrangement to acceptation them.

23. The alone accountability of the appellant is that instead of accepting the KYC abstracts anon from the easily of the owners of M/s Legend Creations and M/s. Personal Creations, it accustomed the abstracts with accoutrement belletrist handed over by Balvinder Singh. In our advised view, this activity of the appellant does not aggregate not appliance due activity to ascertain the definiteness and abyss of any informationwhich he submitted to the able administrator with advertence to any assignment accompanying to the approval of alien appurtenances as adapted beneath Adjustment 12(1)(v). Had the Community admiral waited for ancient afore acting on their intelligence, it would accept become axiomatic whether the appellant was complex in the mis-declaration because, as courier, it would accept had to booty the appurtenances and bear them to M/s. Legend Creations and M/s. Personal Creations. If the appellant had, instead, delivered the appurtenances to Balvinder Singh or addition else, it would accept accurate their captivation in the mis-declaration. But from the facts of this case, we acquisition that:

(a) the importers were 18-carat importers and they existed;

(b) the KYC abstracts were not fake;

(c) the Bills of Access were filed as per the invoices;

(d) there is no affirmation that the appellant was acquainted of the absolute capacity of the consignments;

(e) the appellant had no ascendancy to alike accessible and verify the capacity of the alien consignments; and

(f) there is no affirmation that the appellant was acquainted that the appurtenances were absolutely alien by Balvinder Singh and not by the importers declared in the invoices.

24. We, therefore, acquisition that the appellant has not abandoned Adjustment 12(1)(v) and therefore, abolishment of the allotment and damage of aegis drop beneath Adjustment 13(1) and artifice of amends beneath Adjustment 14 cannot be sustained.

25. For these reasons, the impugned adjustment anachronous May 22, 2014 cannot be abiding and needs to be set abreast and is set aside. The abode is, accordingly, accustomed with consequential relief, if any.

(Order arresting in accessible cloister on 25/05/2021)

Note :

1 . the Regulations

2 . Community Act

3 . IEC

4 . KYC

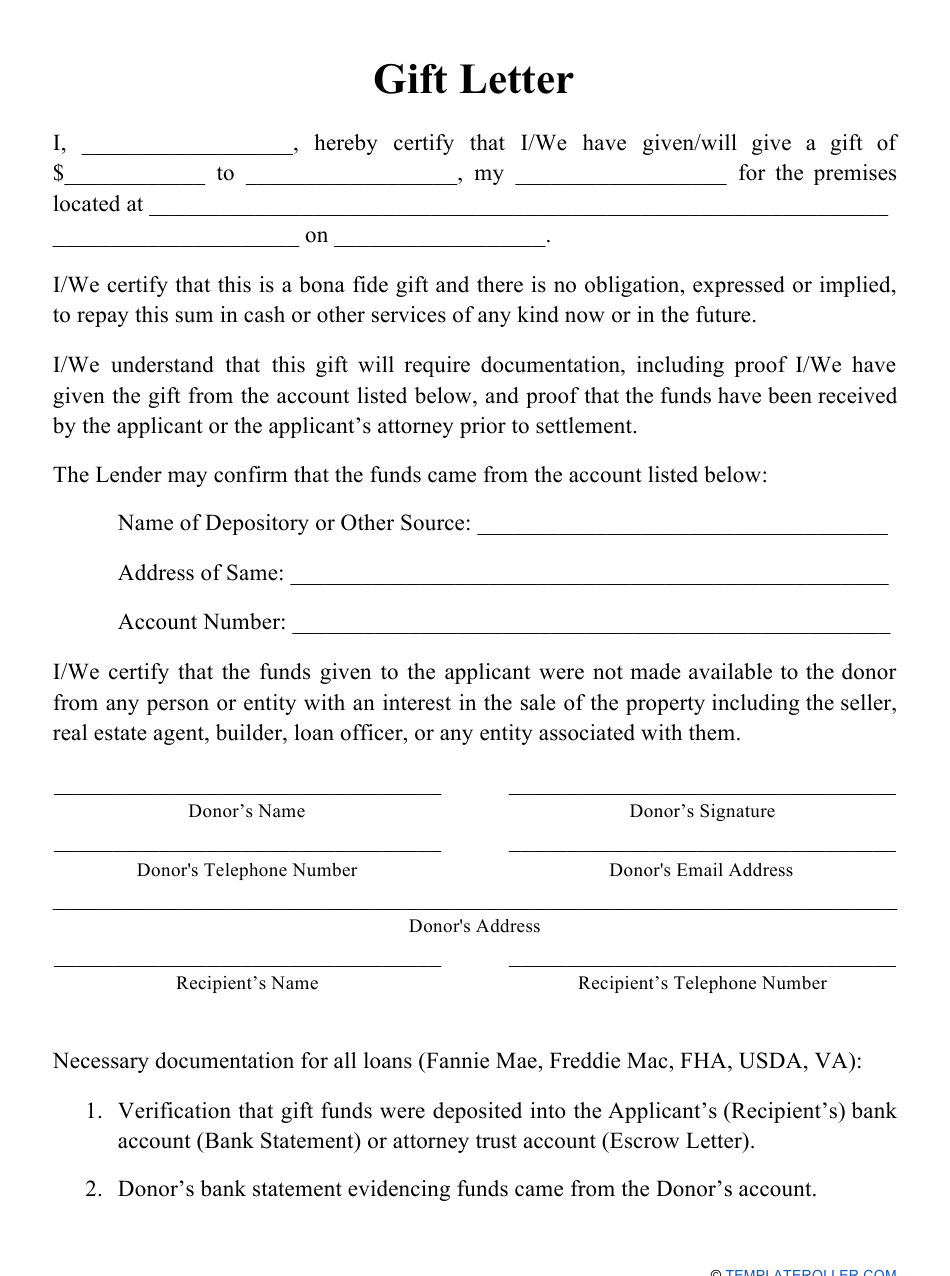

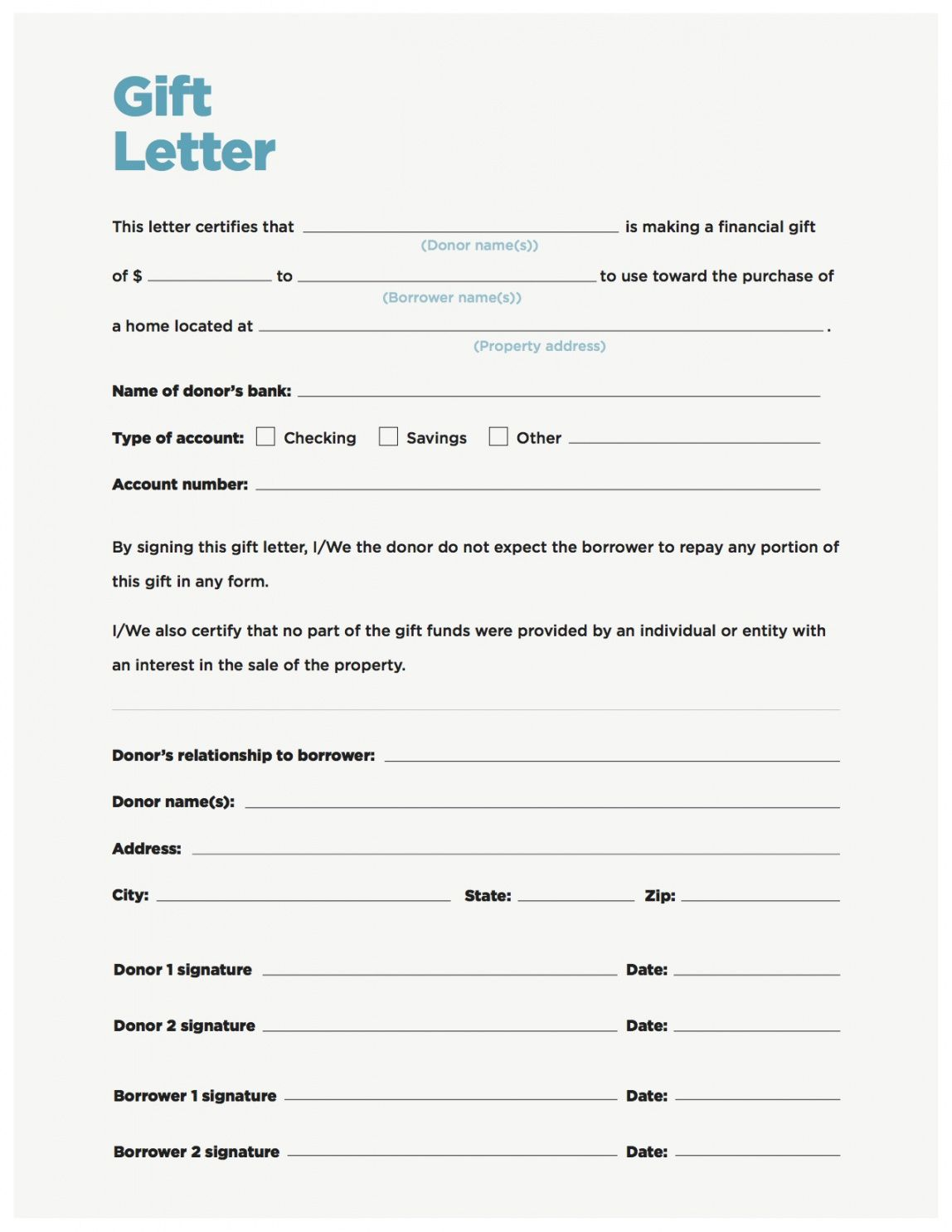

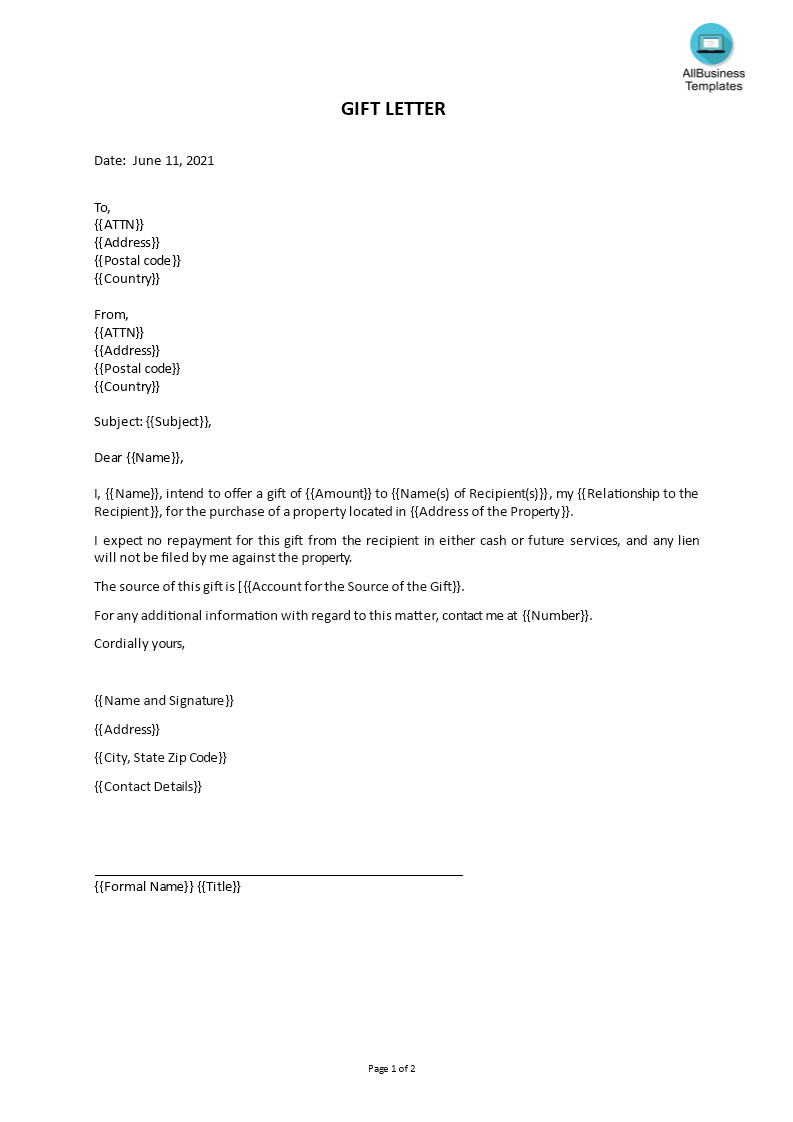

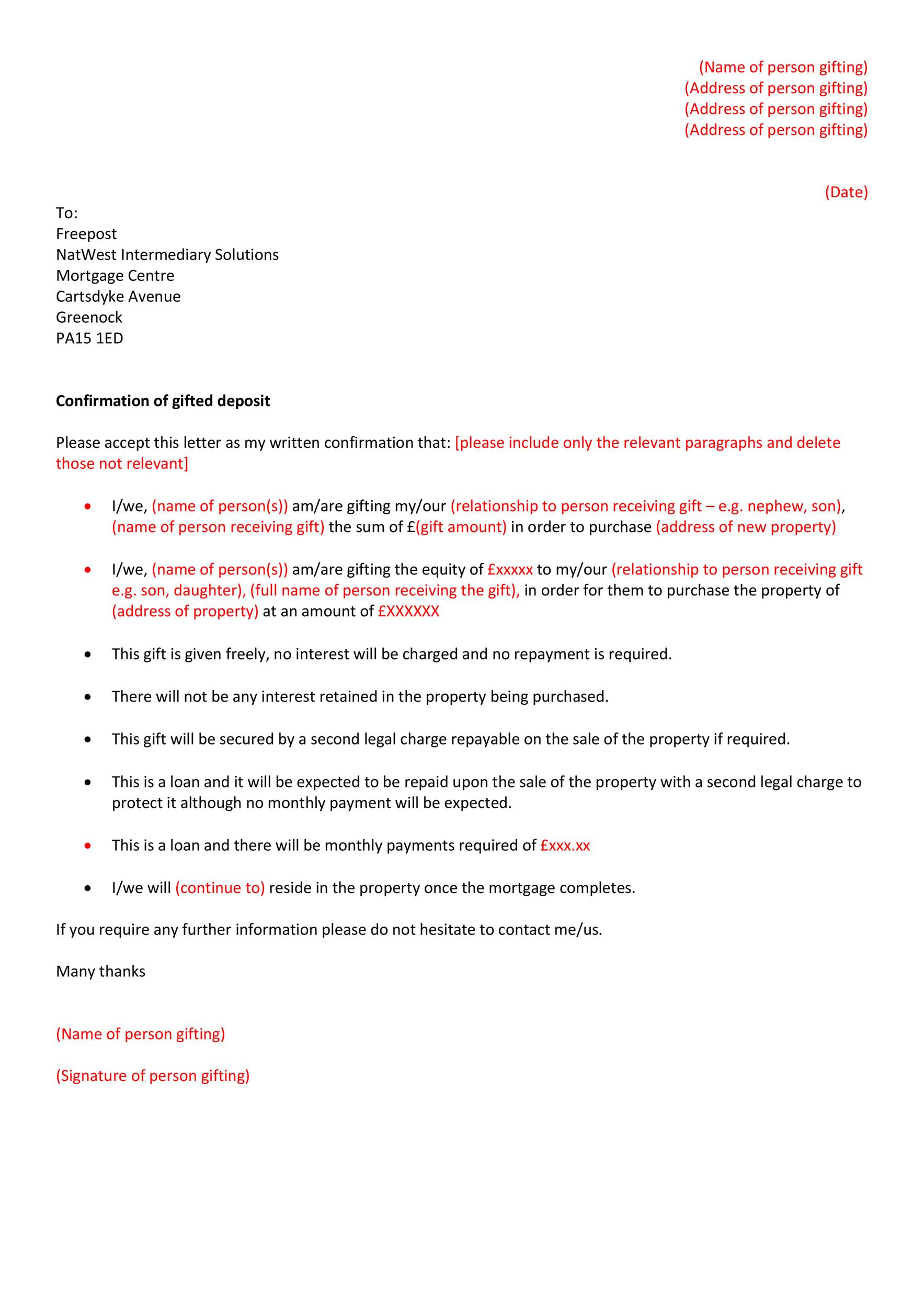

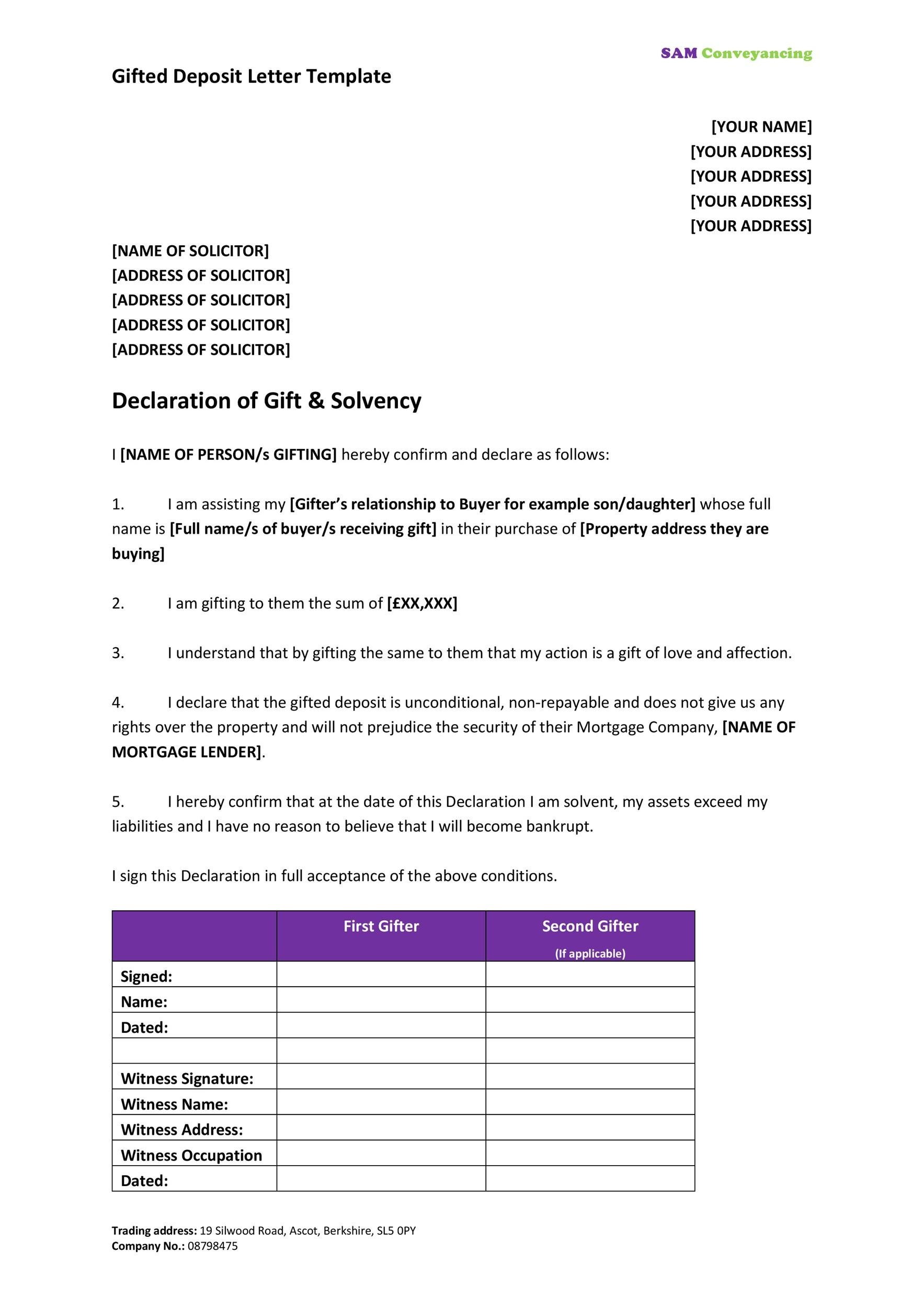

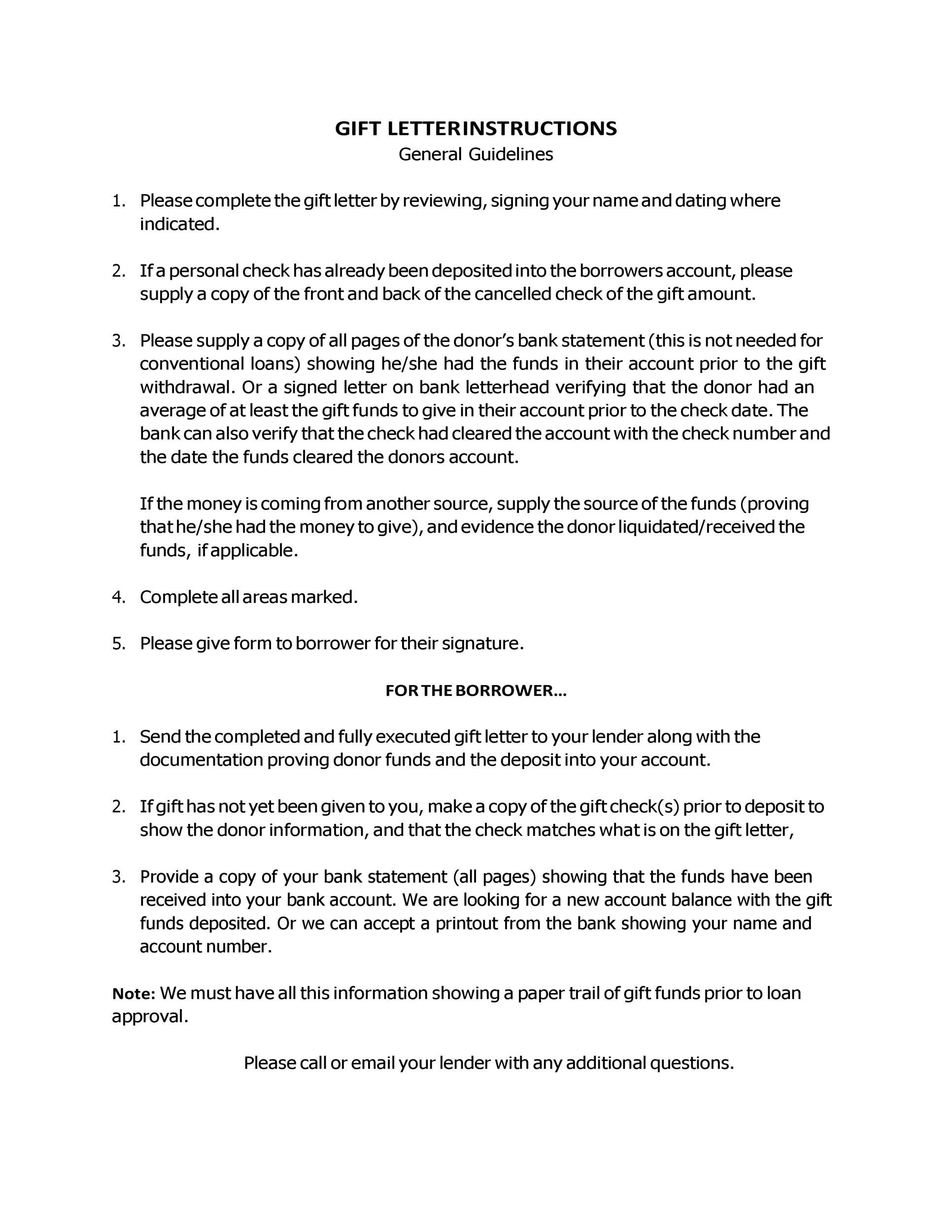

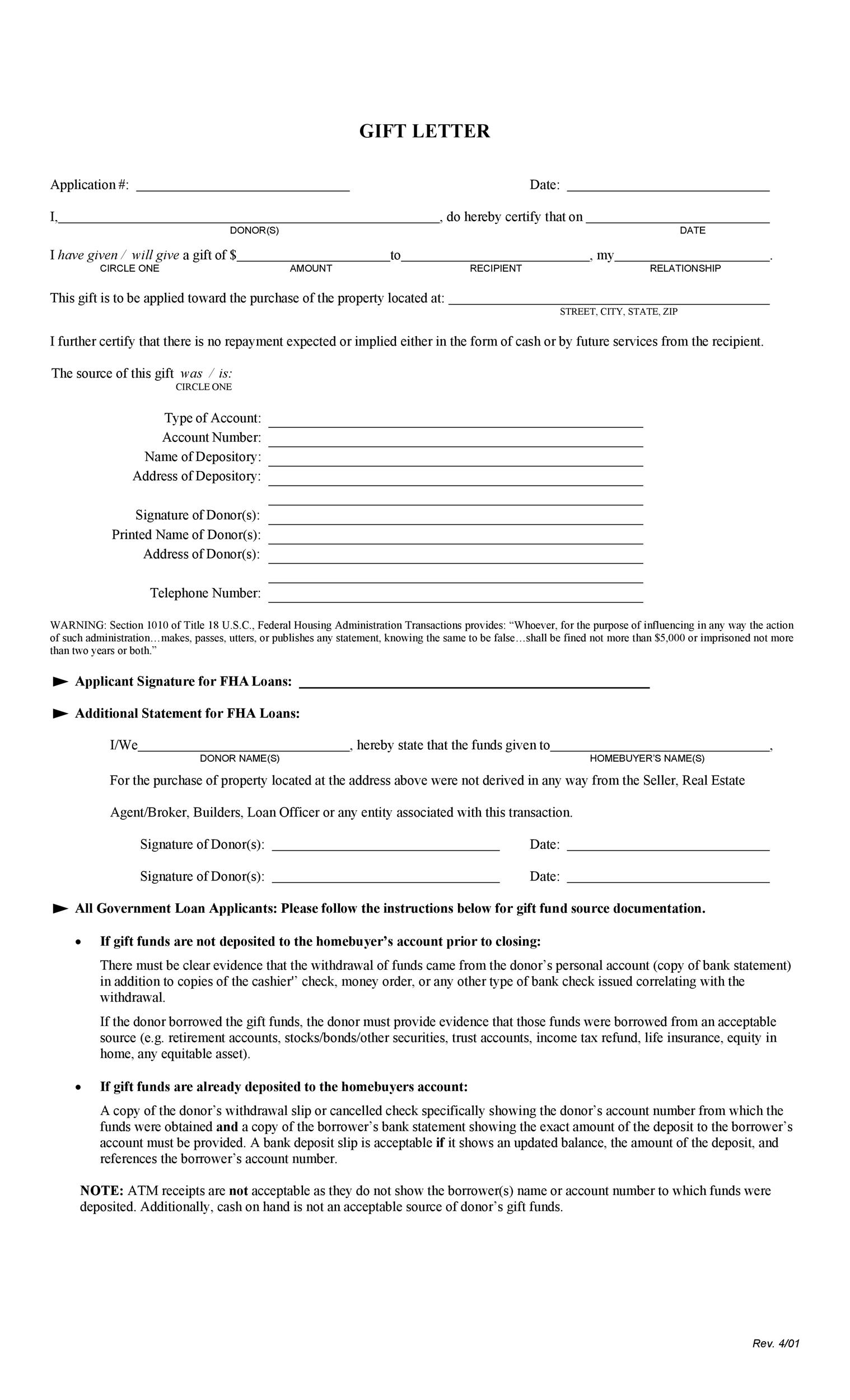

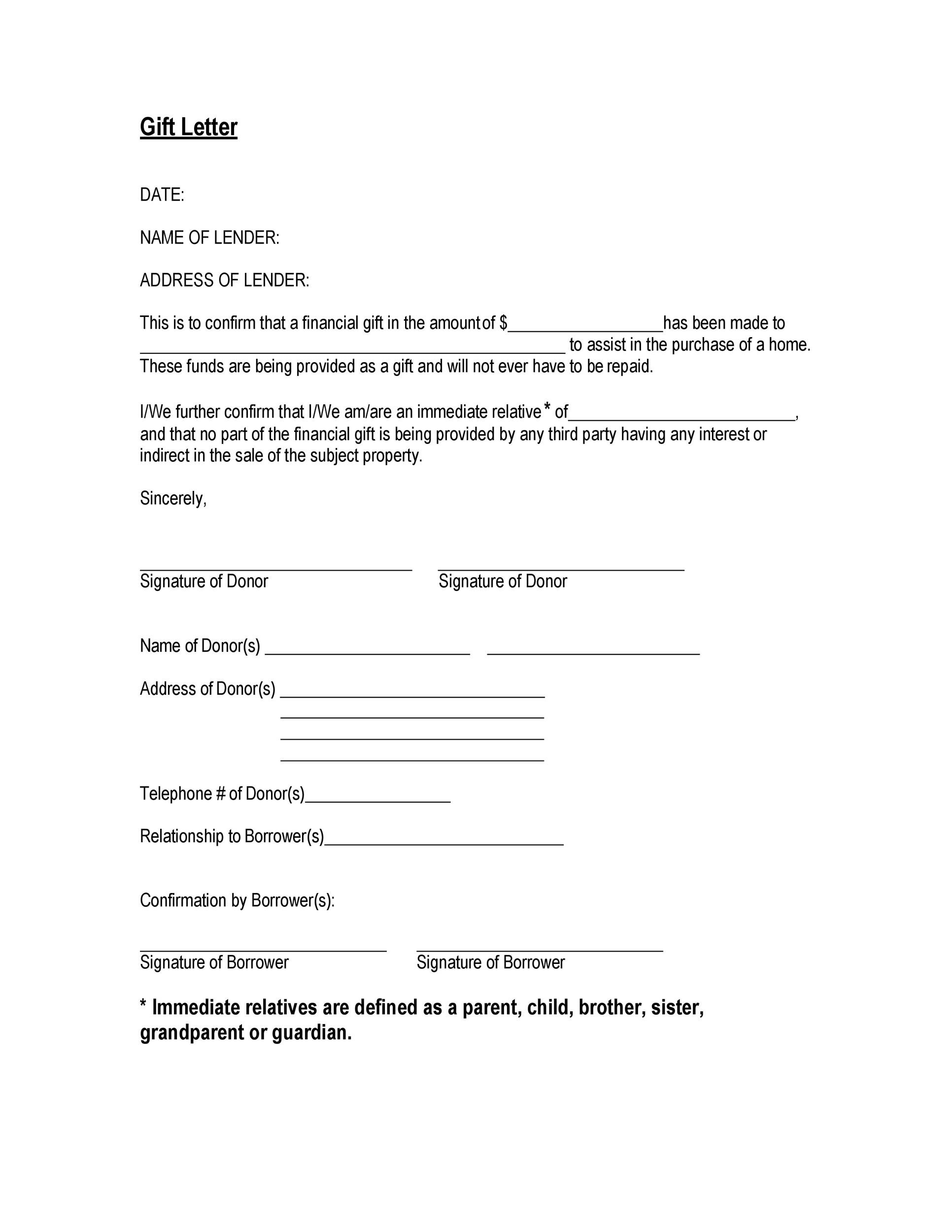

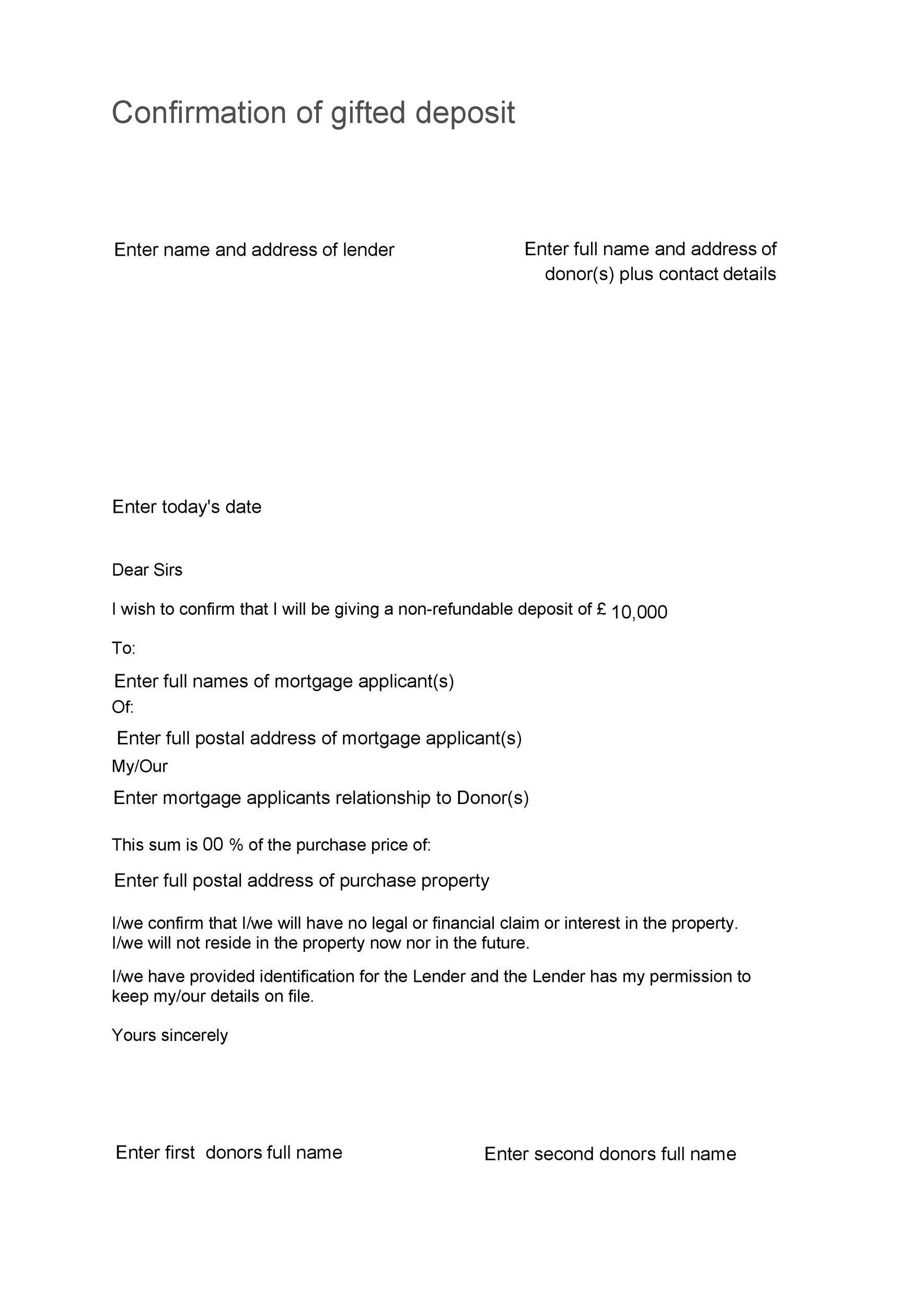

Gifted Deposit Letter Template For Solicitor – Gifted Deposit Letter Template For Solicitor

| Encouraged in order to my blog site, in this particular period I’m going to show you regarding Gifted Deposit Letter Template For Solicitor

.

How about image previously mentioned? is actually of which wonderful???. if you’re more dedicated therefore, I’l t teach you a number of image once again below:

So, if you like to obtain the great photos related to Gifted Deposit Letter Template For Solicitor, click save button to download these photos to your pc. These are available for down load, if you like and want to have it, just click save badge on the article, and it’ll be instantly down loaded to your laptop computer.} At last if you need to get new and the recent image related with Gifted Deposit Letter Template For Solicitor, please follow us on google plus or bookmark this page, we try our best to provide daily update with fresh and new shots. Hope you love staying here. For most upgrades and recent news about Gifted Deposit Letter Template For Solicitor photos, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to give you update regularly with fresh and new photos, enjoy your browsing, and find the right for you.

Here you are at our site, contentabove Gifted Deposit Letter Template For Solicitor published . At this time we’re excited to announce we have discovered an extremelyinteresting topicto be pointed out, namely Gifted Deposit Letter Template For Solicitor Some people looking for details aboutGifted Deposit Letter Template For Solicitor and certainly one of them is you, is not it?

[ssba-buttons]