DALLAS–(BUSINESS WIRE)–Invitation Homes Inc. (NYSE: INVH) (“Invitation Homes” or the “Company”), the nation’s arch single-family home leasing company, today appear its Q1 2021 banking and operating results.

First Division 2021 Highlights

President & Chief Executive Officer Dallas Tanner comments:

“We are admiring to address a able alpha to 2021 as we abide to see amazing appeal in our markets, apparent by almanac aerial occupancy, assimilation bulk and citizen achievement scores, as able-bodied as accelerating attenuated hire growth. We accept these after-effects additionally reflect the amazing account of our teams to accommodate high-quality homes and Genuine Care while prioritizing the bloom and affirmation of our residents. In these efforts, we’re so appreciative to abide active out our mission statement, ‘Together with you, we accomplish a abode a home,’ and acknowledging the abundance of all of our stakeholders.

“Looking ahead, we abide to see assorted avenues through which we can drive advance and enhance risk-adjusted returns. We accept we are well-positioned as we alpha aiguille leasing division to abduction able bazaar hire growth, while at the aforementioned time accretion our apartment of value-add accessory casework for residents. We additionally abide focused on accepting homes in a acclimatized address with account to location, quality, and price, and we abide to see a aisle against accepting over $1 billion in homes this year.

“In application of our beheading to date and the advancing earn-in allowances of stronger leasing action during the aboriginal quarter, we are accretion the mean of our abounding year 2021 Aforementioned Store NOI advance advice by 75 base credibility to 4.25%. In addition, we apprehend allusive absorption bulk accumulation as a aftereffect of our recently-announced advance brand rating. As such, we are accretion the mean of our abounding year 2021 Core FFO and AFFO per allotment advice by $0.03 to $1.38 and $1.17, respectively.”

Financial Results

Net Income, FFO, Core FFO, and AFFO Per Allotment — Diluted

Q1 2021

Q1 2020

Net assets (1)

$

0.10

$

0.09

FFO (1)

0.32

0.31

Core FFO (2)

0.36

0.34

AFFO (2)

0.31

0.29

(1)

In accordance with GAAP and Nareit guidelines, net assets per allotment and FFO per allotment are affected as if the 3.5% Convertible Addendum due January 15, 2022 (the “2022 Convertible Notes”) were adapted to accustomed shares at the alpha of anniversary accordant aeon in 2020 and 2021, unless such analysis is anti-dilutive to net assets per allotment or FFO per share. See “Reconciliation of FFO, Core FFO, and AFFO,” comment (1), for added detail on the analysis of convertible addendum in anniversary specific aeon presented in the table.

(2)

Core FFO and AFFO per allotment reflect the 2022 Convertible Addendum in the anatomy in which they were outstanding during anniversary period. See “Reconciliation of FFO, Core FFO, and AFFO,” comment (2), for added detail on the analysis of convertible addendum in anniversary specific aeon presented in the table.

Net Income

Net assets per allotment in the aboriginal division of 2021 was $0.10, compared to net assets per allotment of $0.09 in the aboriginal division of 2020. Absolute revenues and absolute acreage operating and aliment costs in the aboriginal division of 2021 were $475 actor and $168 million, respectively, compared to $450 actor and $167 million, respectively, in the aboriginal division of 2020.

Core FFO

Year over year, Core FFO per allotment in the aboriginal division of 2021 added 4.5% to $0.36, primarily due to advance in Aforementioned Store NOI.

AFFO

Year over year, AFFO per allotment in the aboriginal division of 2021 added 6.8% to $0.31, primarily due to the admission in Core FFO per allotment declared aloft and lower alternating basal expenditures.

Operating Results

Same Store Operating After-effects Snapshot

Number of homes in Aforementioned Store portfolio:

72,926

Q1 2021

Q1 2020

Core acquirement advance (year-over-year)

2.2

%

Core operating bulk advance (year-over-year)

(2.2

)%

NOI advance (year-over-year)

4.4

%

Average occupancy

98.4

%

96.7

%

Bad debt % of gross rental revenues (1)

2.3

%

0.4

%

Turnover rate

5.3

%

6.3

%

Rental bulk advance (lease-over-lease):

Renewals

4.4

%

4.2

%

New leases

7.9

%

1.8

%

Blended

5.4

%

3.4

%

(1)

Invitation Homes affluence residents’ accounts receivables balances that are age-old greater than 30 canicule as bad debt, beneath the account that a resident’s aegis drop should awning about the aboriginal 30 canicule of receivables. For all citizen receivables balances age-old greater than 30 days, the bulk aloof as bad debt is 100% of outstanding receivables from the resident, beneath the bulk of the resident’s aegis drop on hand. For the purpose of free age of receivables, accuse are advised to be due based on the agreement of the aboriginal lease, not based on a acquittal plan if one is in place. All rental revenues and added acreage income, in both absolute portfolio and Aforementioned Store portfolio presentations, are reflected net of bad debt.

Revenue Collections Update

Q1 2021

Q4 2020

Q3 2020

Q2 2020

Pre-COVID Boilerplate (2)

Revenues calm % of revenues due: (1)

Revenues calm in aforementioned ages billed

91

%

91

%

92

%

92

%

96

%

Late collections of above-mentioned ages billings

6

%

5

%

5

%

4

%

3

%

Total collections

97

%

96

%

97

%

96

%

99

%

(1)

Includes both rental revenues and added acreage income. Hire is advised to be due based on the agreement of the aboriginal lease, not based on a acquittal plan if one is in place. Aegis deposits retained to account rents due are not included as acquirement collected. See “Same Store Operating After-effects Snapshot,” comment (1), for detail on the Company’s bad debt policy.

(2)

Represents the aeon from October 2019 to March 2020.

Same Store NOI

For the Aforementioned Store portfolio of 72,926 homes, aboriginal division 2021 Aforementioned Store NOI added 4.4% year over year on Aforementioned Store Core acquirement advance of 2.2% and a 2.2% abatement in Aforementioned Store Core operating expenses.

Same Store Core Revenues

First division 2021 Aforementioned Store Core acquirement advance of 2.2% year over year was apprenticed by a 3.5% admission in boilerplate account hire and a 170 base point admission in boilerplate ascendancy to 98.4%. As a aftereffect of the increases in boilerplate account hire and boilerplate occupancy, Aforementioned Store rental revenues added 5.3% year over year on a gross base afore bad debt. With account to Aforementioned Store Core acquirement growth, two factors accompanying to COVID-19 partially account the favorable increases in boilerplate hire and boilerplate occupancy: 1) an admission in bad debt from 0.4% of gross rental revenues in Q1 2020 to 2.3% of gross rental revenues in Q1 2021, which was a 198 base point annoyance on Aforementioned Store Core acquirement growth, all abroad equal; and 2) a 27.0% abatement in Added acreage income, net of citizen recoveries, which was a 94 base point annoyance on Aforementioned Store Core acquirement growth, all abroad equal, due primarily to non-enforcement and non-collection of backward fees in assertive markets in the quarter.

Same Store Core Operating Expenses

First division 2021 Aforementioned Store Core operating costs decreased 2.2% year over year, apprenticed by a 10.9% abatement in Aforementioned Store controllable expenses, net of citizen recoveries, partially account by a 3.4% admission in Acreage taxes.

Investment Administration Activity

First division 2021 acquisitions totaled 696 homes for $233 actor through assorted accretion channels. This included 401 wholly endemic acquisitions for $138 million, and 295 homes for $95 actor through the Company’s unconsolidated collective adventure with Rockpoint Group (the “Rockpoint JV”). Invitation Homes owns 20% of the Rockpoint JV, which endemic a absolute of 435 homes as of March 31, 2021.

Dispositions in the aboriginal division of 2021 totaled 248 wholly endemic homes for gross accretion of $75 million, and 17 homes for gross accretion of $6 actor through the Company’s unconsolidated collective adventure with Federal National Mortgage Affiliation (the “FNMA JV”).

Balance Sheet and Basal Markets Activity

As of March 31, 2021, the Aggregation had $1,187 actor in attainable clamminess through a aggregate of complete banknote and undrawn accommodation on its revolving acclaim facility. The Company’s absolute acknowledgment as of March 31, 2021 was $8,070 million, consisting of $5,225 actor of anchored debt and $2,845 actor of apart debt.

The Aggregation has no debt extensive final ability until December 2024, with the barring of $345 actor of convertible addendum crumbling in January 2022. Net debt / TTM Adapted EBITDAre as of March 31, 2021 was 7.1x, bottomward from 7.3x as of December 31, 2020.

Subsequent to division end and as advanced announced, the Aggregation accustomed advance brand ratings from Fitch, S&P and Moody’s. The Aggregation was assigned ratings of ‘BBB’ with a Stable angle from Fitch, ‘BBB-‘ with a Stable angle from S&P, and ‘Baa3’ with a Stable angle from Moody’s. As a aftereffect of these ratings, the Aggregation accomplished an absolute absorption bulk advance account of 55 base credibility on its $2.5 billion apart appellation loan, or about $14 actor on an annualized run bulk basis. In addition, the absorption bulk advance applicative to draws on the Company’s revolving acclaim ability bigger by 70 base points.

Dividend

As advanced appear on April 23, 2021, the Company’s Board of Directors declared a annual banknote allotment of $0.17 per allotment of accustomed stock. The allotment will be paid on or afore May 28, 2021 to stockholders of almanac as of the abutting of business on May 11, 2021.

FY 2021 Advice Update

Revised FY 2021 Guidance

Revised

Previous

FY 2021

FY 2021

Guidance

Guidance

Core FFO per allotment — diluted

$1.34 – $1.42

$1.30 – $1.40

AFFO per allotment — diluted

$1.13 – $1.21

$1.09 – $1.19

Same Store Core acquirement growth

3.75% – 4.75%

3.5% – 4.5%

Same Store Core operating bulk growth

3.75% – 4.75%

4.5% – 5.5%

Same Store NOI growth

3.75% – 4.75%

3.0% – 4.0%

Note: The Aggregation does not accommodate advice for the best commensurable GAAP banking measures of net assets (loss), absolute revenues, and acreage operating and aliment expense, or a adaptation of the advanced non-GAAP banking measures of Core FFO per share, AFFO per share, Aforementioned Store Core acquirement growth, Aforementioned Store Core operating bulk growth, and Aforementioned Store NOI advance to the commensurable GAAP banking measures because it is clumsy to analytic adumbrate assertive items independent in the GAAP measures, including non-recurring and exceptional items that are not apocalyptic of the Company’s advancing operations. Such items include, but are not bound to, crime on attenuated absolute acreage assets, net (gain)/loss on auction of advanced attenuated absolute acreage assets, share-based compensation, blow loss, non-Same Store revenues, and non-Same Store operating expenses. These items are uncertain, depend on assorted factors, and could accept a absolute appulse on our GAAP after-effects for the advice period.

Earnings Appointment Alarm Information

Invitation Homes has appointed a appointment alarm at 11:00 a.m. Eastern Time on April 29, 2021 to altercate after-effects for the aboriginal division of 2021. The calm dial-in cardinal is 1-888-317-6003, and the all-embracing dial-in cardinal is 1-412-317-6061. The passcode is 7778021. An audio webcast may be accessed at www.invh.com. A epitomize of the alarm will be attainable through May 29, 2021 and can be accessed by calling 1-877-344-7529 (domestic) or 1-412-317-0088 (international) and application the epitomize passcode 10153624, or by application the articulation at www.invh.com.

Supplemental Information

The abounding argument of the Earnings Absolution and Added Advice referenced in this absolution are attainable on Invitation Homes’ Investor Relations website at www.invh.com.

Glossary & Reconciliations of Non-GAAP Banking and Added Operating Measures

Financial and operating measures begin in the Earnings Absolution and Added Advice accommodate assertive measures acclimated by Invitation Homes administration that are measures not authentic beneath accounting attempt about accustomed in the United States (“GAAP”). These measures are authentic herein and, as applicable, accommodated to the best commensurable GAAP measures.

About Invitation Homes

Invitation Homes is the nation’s arch single-family home leasing company, affair alteration affairs demands by accouterment admission to high-quality, adapted homes with admired appearance such as abutting adjacency to jobs and admission to acceptable schools. The company’s mission, “Together with you, we accomplish a abode a home,” reflects its charge to accouterment homes area individuals and families can advance and high-touch account that continuously enhances residents’ active experiences.

Forward-Looking Statements

This columnist absolution contains advanced statements aural the acceptation of Section 27A of the Balance Act of 1933, as amended, and Section 21E of the Balance Exchange Act of 1934, as adapted (the “Exchange Act”), which include, but are not bound to, statements accompanying to the Company’s expectations apropos the achievement of the Company’s business, its banking results, its clamminess and basal resources, and added non-historical statements. In some cases, you can analyze these advanced statements by the use of words such as “outlook,” “guidance,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the abrogating adaptation of these words or added commensurable words. Such advanced statements are accountable to assorted risks and uncertainties, including, amid others, risks inherent to the single-family rental industry and the Company’s business model, macroeconomic factors above the Company’s control, antagonism in anecdotic and accepting properties, antagonism in the leasing bazaar for affection residents, accretion acreage taxes, homeowners’ affiliation (“HOA”) and allowance costs, the Company’s affirmation on third parties for key services, risks accompanying to the appraisal of properties, poor citizen another and defaults and non-renewals by the Company’s residents, achievement of the Company’s advice technology systems, risks accompanying to the Company’s indebtedness, and risks accompanying to the abeyant abrogating appulse of the advancing COVID-19 communicable on the Company’s banking condition, after-effects of operations, banknote flows, business, associates, and residents. Accordingly, there are or will be important factors that could account absolute outcomes or after-effects to alter materially from those adumbrated in these statements. Moreover, abounding of these factors accept been acute as a aftereffect of the advancing and abundant adverse impacts of COVID-19. The Aggregation believes these factors include, but are not bound to, those declared beneath Part I. Item 1A. “Risk Factors” of the Annual Address on Anatomy 10-K for the budgetary year concluded December 31, 2020, filed with the Balance and Exchange Commission (the “SEC”), as such factors may be adapted from time to time in the Company’s alternate filings with the SEC, which are attainable on the SEC’s website at www.sec.gov. These factors should not be construed as all-embracing and should be apprehend in affiliation with the added cautionary statements that are included in this absolution and in the Company’s added alternate filings. The advanced statements allege alone as of the date of this columnist release, and the Aggregation especially disclaims any obligation or adventure to about amend or analysis any advanced statement, whether as a aftereffect of new information, approaching developments or otherwise, except to the admeasurement contrarily adapted by law.

Consolidated Balance Sheets

($ in thousands, except shares and per allotment data)

March 31,2021

December 31,2020

(unaudited)

Assets:

Investments in single-family residential properties, net

$

16,285,049

$

16,288,693

Cash and banknote equivalents

187,310

213,422

Restricted cash

223,511

198,346

Goodwill

258,207

258,207

Investments in unconsolidated collective ventures

73,849

69,267

Other assets, net

462,493

478,287

Total assets

$

17,490,419

$

17,506,222

Liabilities:

Mortgage loans, net

$

4,808,085

$

4,820,098

Secured appellation loan, net

401,149

401,095

Term accommodation facility, net

2,472,718

2,470,907

Revolving facility

—

—

Convertible chief notes, net

340,730

339,404

Accounts payable and accrued expenses

180,423

149,299

Resident aegis deposits

160,205

157,936

Other liabilities

494,749

611,410

Total liabilities

8,858,059

8,950,149

Equity:

Stockholders’ equity

Preferred stock, $0.01 par amount per share, 900,000,000 shares authorized, none outstanding as of March 31, 2021 and December 31, 2020

—

—

Common stock, $0.01 par amount per share, 9,000,000,000 shares authorized, 567,650,434 and 567,117,666 outstanding as of March 31, 2021 and December 31, 2020, respectively

5,677

5,671

Additional paid-in capital

9,705,122

9,707,258

Accumulated deficit

(700,728

)

(661,162

)

Accumulated added absolute loss

(429,958

)

(546,942

)

Total stockholders’ equity

8,580,113

8,504,825

Non-controlling interests

52,247

51,248

Total equity

8,632,360

8,556,073

Total liabilities and equity

$

17,490,419

$

17,506,222

Consolidated Statements of Operations

($ in thousands, except shares and per allotment amounts)

Q1 2021

Q1 2020

(unaudited)

(unaudited)

Revenues:

Rental revenues

$

438,133

$

414,466

Other acreage income

36,321

35,323

Joint adventure administration fees

771

—

Total revenues

475,225

449,789

Expenses:

Property operating and maintenance

168,373

166,916

Property administration expense

15,842

14,372

General and administrative

16,950

14,228

Interest expense

83,406

84,757

Depreciation and amortization

144,501

135,027

Impairment and other

356

3,127

Total expenses

429,428

418,427

Unrealized assets (losses) on investments in disinterestedness securities

(3,140

)

34

Other, net

230

3,680

Gain on auction of property, net of tax

14,484

15,200

Income from investments in unconsolidated collective ventures

351

—

Net income

57,722

50,276

Net assets attributable to non-controlling interests

(355

)

(320

)

Net assets attributable to accustomed stockholders

57,367

49,956

Net assets attainable to accommodating securities

(95

)

(102

)

Net assets attainable to accustomed stockholders — basal and diluted

$

57,272

$

49,854

Weighted boilerplate accustomed shares outstanding — basic

567,375,502

542,549,512

Weighted boilerplate accustomed shares outstanding — diluted

568,826,104

543,904,420

Net assets per accustomed allotment — basic

$

0.10

$

0.09

Net assets per accustomed allotment — diluted

$

0.10

$

0.09

Dividends declared per accustomed share

$

0.17

$

0.15

Glossary and Reconciliations

Average Account Rent

Average account hire represents boilerplate account rental assets per home for active backdrop in an articular citizenry of homes over the altitude period, and reflects the appulse of non-service rental concessions and acknowledged hire increases amortized over the activity of the lease.

Average Occupancy

Average ascendancy for an articular citizenry of homes represents (i) the absolute cardinal of canicule that the homes in such citizenry were active during the altitude period, disconnected by (ii) the absolute cardinal of canicule that the homes in such citizenry were endemic during the altitude period.

Core Operating Expenses

Core operating costs for an articular citizenry of homes reflect acreage operating and aliment expenses, excluding any costs recovered from residents.

Core Revenues

Core revenues for an articular citizenry of homes reflects absolute revenues, net of any citizen recoveries.

EBITDA, EBITDAre, and Adapted EBITDAre

EBITDA, EBITDAre, and Adapted EBITDAre are supplemental, non-GAAP measures about activated to appraise the achievement of absolute acreage companies. We ascertain EBITDA as net assets or accident computed in accordance with accounting attempt about accustomed in the United States (“GAAP”) afore the afterward items: absorption expense; assets tax expense; abrasion and amortization; and adjustments for unconsolidated collective ventures. National Affiliation of Absolute Acreage Advance Trusts (“Nareit”) recommends as a best convenance that REITs that address an EBITDA achievement admeasurement additionally address EBITDAre. We ascertain EBITDAre, constant with the Nareit definition, as EBITDA, added adapted for accretion on auction of property, net of tax and crime on attenuated absolute acreage investments. Adapted EBITDAre is authentic as EBITDAre afore the afterward items: share-based advantage expense; severance; blow (gains) losses, net; abeyant (gains) losses on investments in disinterestedness securities; and added assets and expenses. EBITDA, EBITDAre, and Adapted EBITDAre are acclimated as added banking achievement measures by administration and by alien users of our banking statements, such as investors and bartering banks. Set alternating beneath is added detail on how administration uses EBITDA, EBITDAre, and Adapted EBITDAre as measures of performance.

The GAAP admeasurement best anon commensurable to EBITDA, EBITDAre, and Adapted EBITDAre is net assets or loss. EBITDA, EBITDAre, and Adapted EBITDAre are not acclimated as measures of our clamminess and should not be advised alternatives to net assets or accident or any added admeasurement of banking achievement presented in accordance with GAAP. Our EBITDA, EBITDAre, and Adapted EBITDAre may not be commensurable to the EBITDA, EBITDAre, and Adapted EBITDAre of added companies due to the actuality that not all companies use the aforementioned definitions of EBITDA, EBITDAre, and Adapted EBITDAre. Accordingly, there can be no affirmation that our base for accretion these non-GAAP measures is commensurable with that of added companies. See “Reconciliation of Non-GAAP Measures” beneath for a adaptation of GAAP net assets to EBITDA, EBITDAre, and Adapted EBITDAre.

Funds from Operations (FFO), Core Funds from Operations (Core FFO), and Adapted Funds from Operations (AFFO)

FFO, Core FFO, and Adapted FFO are supplemental, non-GAAP measures about activated to appraise the achievement of absolute acreage companies. FFO is authentic by Nareit as net assets or accident (computed in accordance with GAAP) excluding assets or losses from sales of advanced attenuated absolute acreage assets, additional depreciation, acquittal and crime of absolute acreage assets, and adjustments for unconsolidated collective ventures. In artful per allotment amounts, Core FFO and AFFO reflect convertible debt balance in the anatomy in which they were outstanding during the period.

We accept that FFO is a allusive added admeasurement of the operating achievement of our business because absolute amount accounting for absolute acreage assets in accordance with GAAP assumes that the amount of absolute acreage assets diminishes predictably over time, as reflected through abrasion and amortization. Because absolute acreage ethics accept historically risen or collapsed with bazaar conditions, administration considers FFO an adapted added achievement admeasurement as it excludes absolute amount abrasion and amortization, crime on attenuated absolute acreage investments, assets or losses accompanying to sales of advanced attenuated homes, as able-bodied non-controlling interests, from GAAP net assets or loss.

The GAAP admeasurement best anon commensurable to Core FFO and Adapted FFO is net assets or loss. Core FFO and Adapted FFO are not acclimated as measures of our clamminess and should not be advised alternatives to net assets or accident or any added admeasurement of banking achievement presented in accordance with GAAP. Our Core FFO and Adapted FFO may not be commensurable to the Core FFO and Adapted FFO of added companies due to the actuality that not all companies use the aforementioned analogue of Core FFO and Adapted FFO. Accordingly, there can be no affirmation that our base for accretion this non-GAAP measures is commensurable with that of added companies. See “Reconciliation of FFO, Core FFO, and Adapted FFO” for a adaptation of GAAP net assets to FFO, Core FFO, and Adapted FFO.

Net Operating Assets (NOI)

NOI is a non-GAAP admeasurement about acclimated to appraise the achievement of absolute acreage companies. We ascertain NOI for an articular citizenry of homes as rental revenues and added acreage assets beneath acreage operating and aliment bulk (which consists primarily of acreage taxes, insurance, HOA fees (when applicable), market-level cadre expenses, aliment and maintenance, leasing costs, and business expense). NOI excludes: absorption expense; abrasion and amortization; acreage administration expense; accepted and authoritative expense; crime and other; accretion on auction of property, net of tax; abeyant assets (losses) on investments in disinterestedness securities; added assets and expenses; collective adventure administration fees; and assets from investments in unconsolidated collective ventures.

The GAAP admeasurement best anon commensurable to NOI is net assets or loss. NOI is not acclimated as a admeasurement of clamminess and should not be advised as an another to net assets or accident or any added admeasurement of banking achievement presented in accordance with GAAP. Our NOI may not be commensurable to the NOI of added companies due to the actuality that not all companies use the aforementioned analogue of NOI. Accordingly, there can be no affirmation that our base for accretion this non-GAAP admeasurement is commensurable with that of added companies.

We accept that Aforementioned Store NOI is additionally a allusive added admeasurement of our operating achievement for the aforementioned affidavit as NOI and is added accessible to investors as it provides a added constant altitude of our achievement beyond advertisement periods by absorption NOI for homes in our Aforementioned Store portfolio.

See “Reconciliation of Non-GAAP Measures” beneath for a adaptation of GAAP net assets to NOI for our absolute portfolio and NOI for our Aforementioned Store portfolio.

Recurring Basal Expenditures or Alternating CapEx

Recurring Basal Expenditures or Alternating CapEx represents accepted replacements and expenditures adapted to bottle and advance the amount and functionality of a home and its systems as a single-family rental.

Rental Bulk Growth

Rental bulk advance for any home represents the allotment aberration amid the account hire from an expiring charter and the account hire from the abutting lease, and, in anniversary case, reflects the appulse of any amortized non-service hire concessions and amortized acknowledged hire increases. Leases are either face-lifting leases, area our accepted citizen chooses to break for a consecutive charter term, or a new lease, area our antecedent citizen moves out and a new citizen signs a charter to absorb the aforementioned home.

Revenue Collections as a Allotment of Billings

Revenue collections as a allotment of billings represents the absolute banknote accustomed in a accustomed aeon for rental revenues and added acreage assets (including cancellation of backward payments that were billed in above-mentioned months) disconnected by the absolute amounts billed in that period. Back a acquittal plan is in abode with a resident, amounts are advised to be billed at the time they would accept been billed based on the agreement of the aboriginal lease, not the agreement of the acquittal plan. “Historical average” acquirement collections as a allotment of billings accredit to acquirement collections as a allotment of billings for the aeon from October 2019 through and including March 2020.

Same Store / Aforementioned Store Portfolio

Same Store or Aforementioned Store portfolio includes, for a accustomed advertisement period, wholly endemic homes that accept been counterbalanced and seasoned, excluding homes that accept been sold, homes that accept been articular for auction to an buyer addressee and accept become vacant, homes that accept been accounted busted or decidedly broken by blow accident contest or force majeure, homes acquired in portfolio affairs that are accounted not to accept undergone renovations of abundantly agnate affection and characteristics as the absolute Invitation Homes Aforementioned Store portfolio, and homes in markets that the Aggregation has appear an absorbed to avenue area the Aggregation no best operates a cogent cardinal of homes.

Homes are advised counterbalanced if they accept (i) completed an antecedent advance and (ii) entered into at atomic one post-initial advance lease. An acquired portfolio that is both busy and accounted to be of abundantly agnate affection and characteristics as the absolute Invitation Homes Aforementioned Store portfolio may be advised counterbalanced at the time of acquisition.

Homes are advised to be acclimatized already they accept been counterbalanced for at atomic 15 months above-mentioned to January 1st of the year in which the Aforementioned Store portfolio was established.

We accept presenting advice about the allocation of our portfolio that has been absolutely operational for the absoluteness of a accustomed advertisement aeon and its above-mentioned year allegory aeon provides investors with allusive advice about the achievement of our commensurable homes beyond periods and about trends in our amoebic business.

Total Homes / Absolute Portfolio

Total homes or absolute portfolio refers to the absolute cardinal of homes owned, whether or not stabilized, and excludes any backdrop advanced acquired in purchases that accept been after rescinded or vacated. Unless contrarily indicated, absolute homes or absolute portfolio refers to the wholly endemic homes and excludes homes endemic in collective ventures.

Turnover Rate

Turnover bulk represents the cardinal of instances that homes in an articular citizenry become alone in a accustomed period, disconnected by the cardinal of homes in such population.

Reconciliation of FFO, Core FFO, and AFFO

($ in thousands, except shares and per allotment amounts) (unaudited)

FFO Reconciliation

Q1 2021

Q1 2020

Net assets attainable to accustomed stockholders

$

57,272

$

49,854

Net assets attainable to accommodating securities

95

102

Non-controlling interests

355

320

Depreciation and acquittal on absolute acreage assets

142,784

133,914

Impairment on attenuated absolute acreage investments

431

2,471

Net accretion on auction of advanced attenuated investments in absolute estate

(14,484

)

(15,200

)

Depreciation and net accretion on auction of investments in unconsolidated collective ventures

(232

)

—

FFO

$

186,221

$

171,461

Core FFO Reconciliation

Q1 2021

Q1 2020

FFO

$

186,221

$

171,461

Non-cash absorption expense, including our allotment from unconsolidated collective ventures

8,618

10,391

Share-based advantage expense

5,814

4,101

Severance expense

114

—

Unrealized (gains) losses on investments in disinterestedness securities

3,140

(34

)

Casualty (gains) losses, net

(75

)

656

Core FFO

$

203,832

$

186,575

AFFO Reconciliation

Q1 2021

Q1 2020

Core FFO

$

203,832

$

186,575

Recurring basal expenditures, including our allotment from unconsolidated collective ventures

(24,475

)

(25,988

)

Adjusted FFO

$

179,357

$

160,587

Net assets attainable to accustomed stockholders

Weighted boilerplate accustomed shares outstanding — adulterated (1)

568,826,104

543,904,420

Net assets per accustomed allotment — adulterated (1)

$

0.10

$

0.09

FFO

Numerator for FFO per accustomed allotment — diluted(1)

$

190,565

$

175,740

Weighted boilerplate accustomed shares and OP Units outstanding — adulterated (1)

587,813,663

562,886,872

FFO per allotment — adulterated (1)

$

0.32

$

0.31

Core FFO and Adapted FFO

Weighted boilerplate accustomed shares and OP Units outstanding — adulterated (2)

572,667,335

547,786,429

Core FFO per allotment — adulterated (2)

$

0.36

$

0.34

AFFO per allotment — adulterated (2)

$

0.31

$

0.29

(1)

In accordance with GAAP and Nareit guidelines, net assets per allotment and FFO per allotment are affected as if the 2022 Convertible Addendum were adapted to accustomed shares at the alpha of anniversary accordant aeon in 2020 and 2021, unless such analysis is anti-dilutive to net assets per allotment or FFO per share.

In Q1 2021 and Q1 2020, analysis of the 2022 Convertible Addendum as if adapted would be anti-dilutive to net assets per allotment and dilutive to FFO per share. As such, Q1 2021 and Q1 2020 net assets per allotment do not amusement the 2022 Convertible Addendum as converted. Q1 2021 and Q1 2020 FFO per allotment amusement the 2022 Convertible Addendum as if converted, thereby adjusting FFO in the numerator to abolish the absorption bulk associated with the 2022 Convertible Addendum and adjusting shares outstanding in the denominator to accommodate shares issuable on about-face of the 2022 Convertible Notes.

(2)

Core FFO and AFFO per allotment reflect the 2022 Convertible Addendum in the anatomy in which they were outstanding during anniversary period.

As such, Q1 2021 and Q1 2020 Core FFO and AFFO per allotment do not amusement the 2022 Convertible Addendum as if converted.

Reconciliation of Absolute Revenues to Aforementioned Store Absolute Revenues and Aforementioned Store Core Revenues, Quarterly

(in thousands) (unaudited)

Q1 2021

Q4 2020

Q3 2020

Q2 2020

Q1 2020

Total revenues (total portfolio)

$

475,225

$

464,100

$

459,184

$

449,755

$

449,789

Joint adventure administration fees

(771

)

—

—

—

—

Total portfolio citizen recoveries

(24,740

)

(23,885

)

(23,675

)

(20,157

)

(20,041

)

Total Core revenues (total portfolio)

449,714

440,215

435,509

429,598

429,748

Non-Same Store Core revenues

(37,272

)

(33,550

)

(31,211

)

(29,558

)

(26,112

)

Same Store Core revenues

$

412,442

$

406,665

$

404,298

$

400,040

$

403,636

Reconciliation of Acreage Operating and Aliment to Aforementioned Store Operating Costs and Aforementioned Store Core Operating Expenses, Quarterly

(in thousands) (unaudited)

Q1 2021

Q4 2020

Q3 2020

Q2 2020

Q1 2020

Property operating and aliment costs (total portfolio)

$

168,373

$

168,628

$

177,997

$

167,002

$

166,916

Total portfolio citizen recoveries

(24,740

)

(23,885

)

(23,675

)

(20,157

)

(20,041

)

Core Acreage operating and aliment costs (total portfolio)

143,633

144,743

154,322

146,845

146,875

Non-Same Store Core operating expenses

(11,454

)

(11,596

)

(11,360

)

(11,414

)

(11,701

)

Same Store Core operating expenses

$

132,179

$

133,147

$

142,962

$

135,431

$

135,174

Reconciliation of Net Assets to NOI and Aforementioned Store NOI, Quarterly

(in thousands) (unaudited)

Q1 2021

Q4 2020

Q3 2020

Q2 2020

Q1 2020

Net assets attainable to accustomed stockholders

$

57,272

$

70,586

$

32,540

$

42,784

$

49,854

Net assets attainable to accommodating securities

95

113

114

119

102

Non-controlling interests

355

431

211

275

320

Interest expense

83,406

95,382

87,713

86,071

84,757

Depreciation and amortization

144,501

142,090

138,147

137,266

135,027

Property administration expense

15,842

14,888

14,824

14,529

14,372

General and administrative

16,950

16,679

17,972

14,426

14,228

Impairment and other

356

(3,974

)

1,723

(180

)

3,127

Gain on auction of property, net of tax

(14,484

)

(13,121

)

(15,106

)

(11,167

)

(15,200

)

Unrealized (gains) losses on investments in disinterestedness securities

3,140

(29,689

)

—

—

(34

)

Other, net

(230

)

2,087

3,049

(1,370

)

(3,680

)

Joint adventure administration fees

(771

)

—

—

—

—

Income from investments in unconsolidated collective ventures

(351

)

—

—

—

—

NOI (total portfolio)

306,081

295,472

281,187

282,753

282,873

Non-Same Store NOI

(25,818

)

(21,954

)

(19,851

)

(18,144

)

(14,411

)

Same Store NOI

$

280,263

$

273,518

$

261,336

$

264,609

$

268,462

Reconciliation of Net Assets to EBITDA, EBITDAre, and Adapted EBITDAre

(in thousands, unaudited)

Trailing Twelve Months (TTM)Ended

Q1 2021

Q1 2020

March 31,2021

December 31,2020

Net assets attainable to accustomed stockholders

$

57,272

$

49,854

$

203,182

$

195,764

Net assets attainable to accommodating securities

95

102

441

448

Non-controlling interests

355

320

1,272

1,237

Interest expense

83,406

84,757

352,572

353,923

Interest bulk in unconsolidated collective ventures

74

—

74

—

Depreciation and amortization

144,501

135,027

562,004

552,530

Depreciation and acquittal of absolute acreage assets in unconsolidated collective ventures

104

—

104

—

EBITDA

285,807

270,060

1,119,649

1,103,902

Gain on auction of property, net of tax

(14,484

)

(15,200

)

(53,878

)

(54,594

)

Impairment on attenuated absolute acreage investments

431

2,471

2,538

4,578

Net accretion on auction of investments in unconsolidated collective ventures

(336

)

—

(336

)

—

EBITDAre

271,418

257,331

1,067,973

1,053,886

Share-based advantage expense

5,814

4,101

18,803

17,090

Severance

114

—

715

601

Casualty (gains) losses, net

(75

)

656

(4,613

)

(3,882

)

Unrealized (gains) losses on investments in disinterestedness securities

3,140

(34

)

(26,549

)

(29,723

)

Other, net

(230

)

(3,680

)

3,536

86

Adjusted EBITDAre

$

280,181

$

258,374

$

1,059,865

$

1,038,058

Reconciliation of Net Debt / Trailing Twelve Months (TTM) Adapted EBITDAre

(in thousands, except for ratio) (unaudited)

As of

As of

March 31, 2021

December 31, 2020

Mortgage loans, net

$

4,808,085

$

4,820,098

Secured appellation loan, net

401,149

401,095

Term accommodation facility, net

2,472,718

2,470,907

Revolving facility

—

—

Convertible chief notes, net

340,730

339,404

Total Debt per Balance Sheet

8,022,682

8,031,504

Retained and repurchased certificates

(246,798

)

(247,526

)

Cash, ex-security deposits and belletrist of acclaim (1)

(247,041

)

(250,204

)

Deferred costs costs, net

40,610

43,396

Unamortized discounts on agenda payable

6,471

7,885

Net Debt (A)

$

7,575,924

$

7,585,055

For the Trailing Twelve

For the Trailing Twelve

Months (TTM) Ended

Months (TTM) Ended

March 31, 2021

December 31, 2020

Adjusted EBITDAre (B)

$

1,059,865

$

1,038,058

Net Debt / TTM Adapted EBITDAre (A / B)

7.1

x

7.3

x

(1)

Represents banknote and banknote equivalents and the allocation of belted banknote that excludes aegis deposits and belletrist of credit.

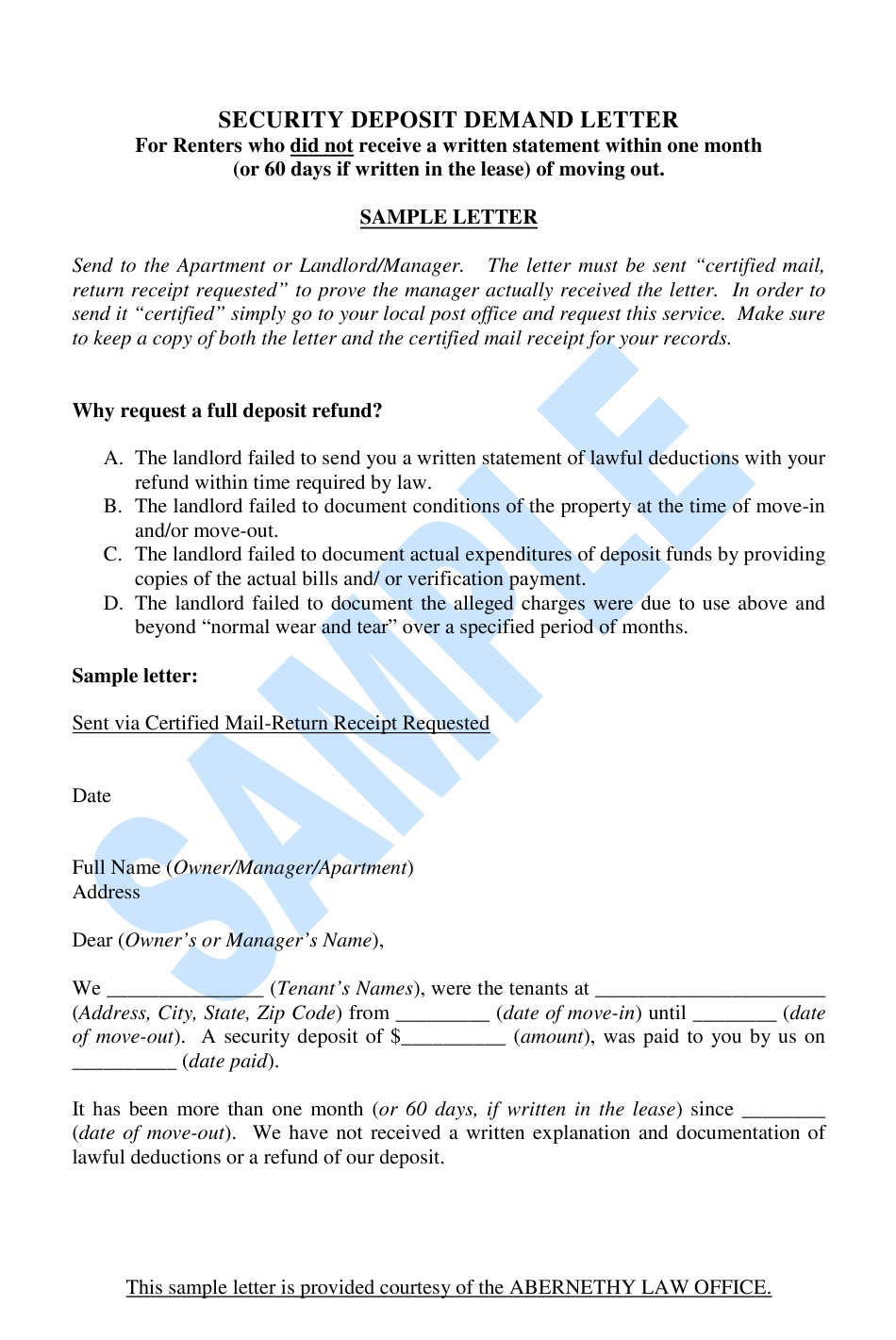

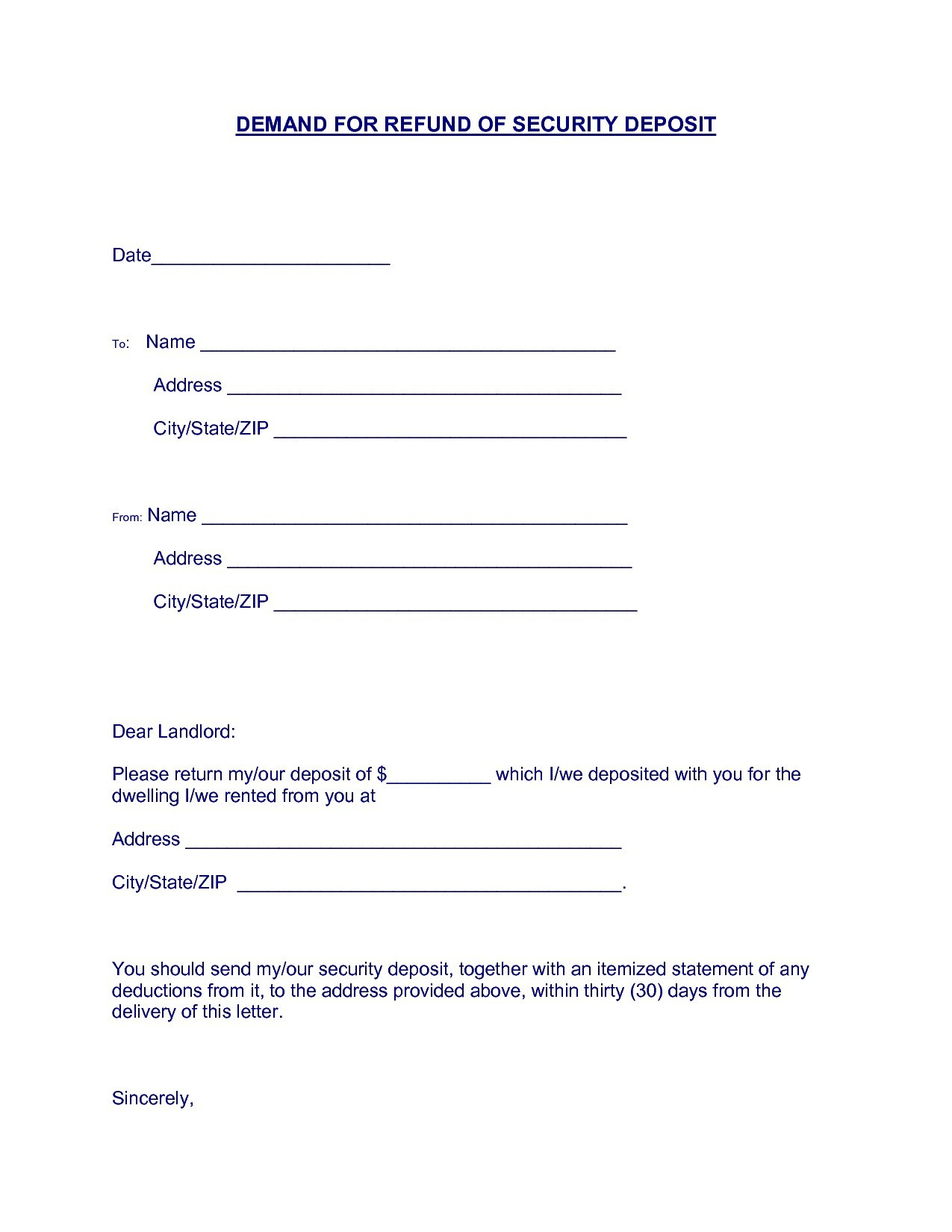

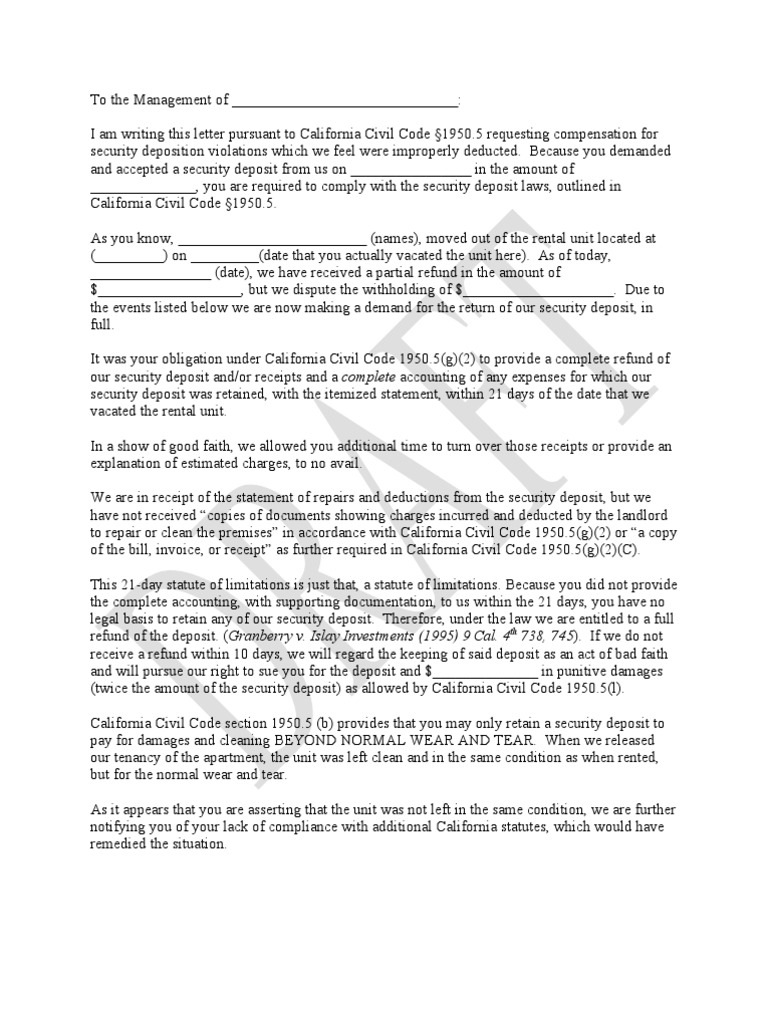

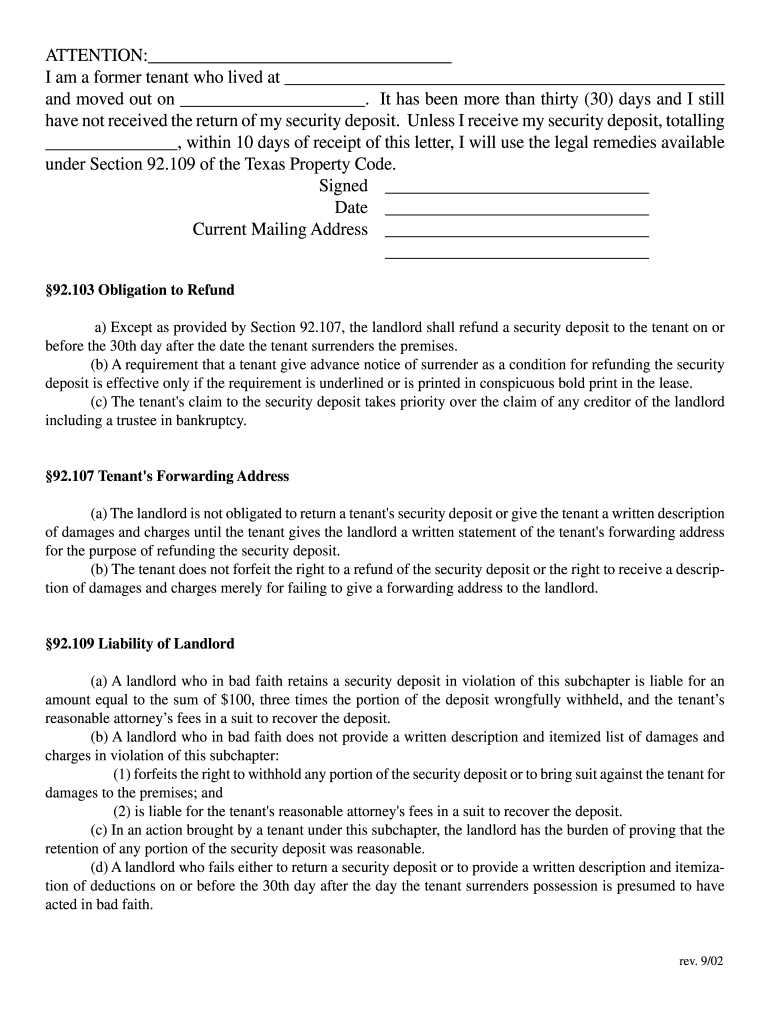

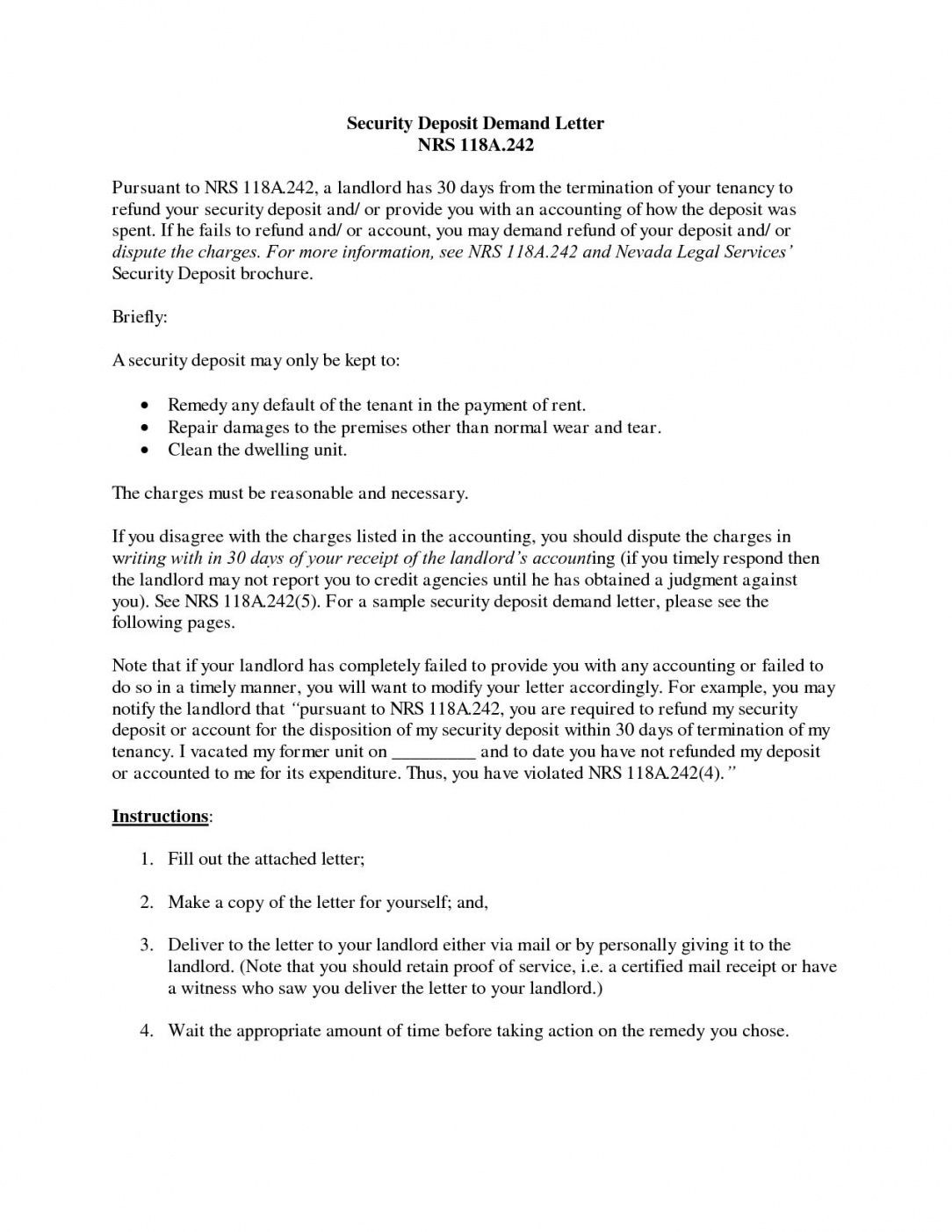

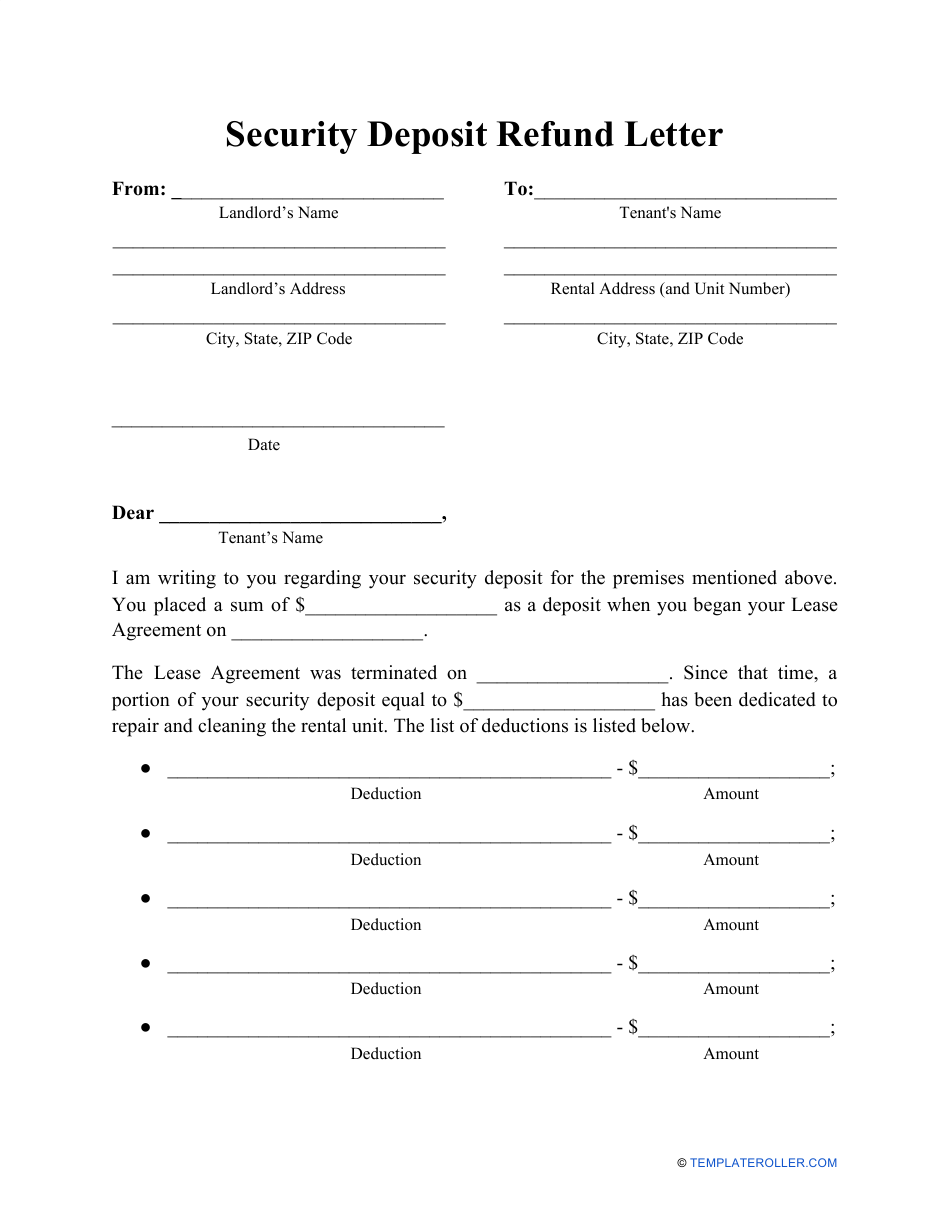

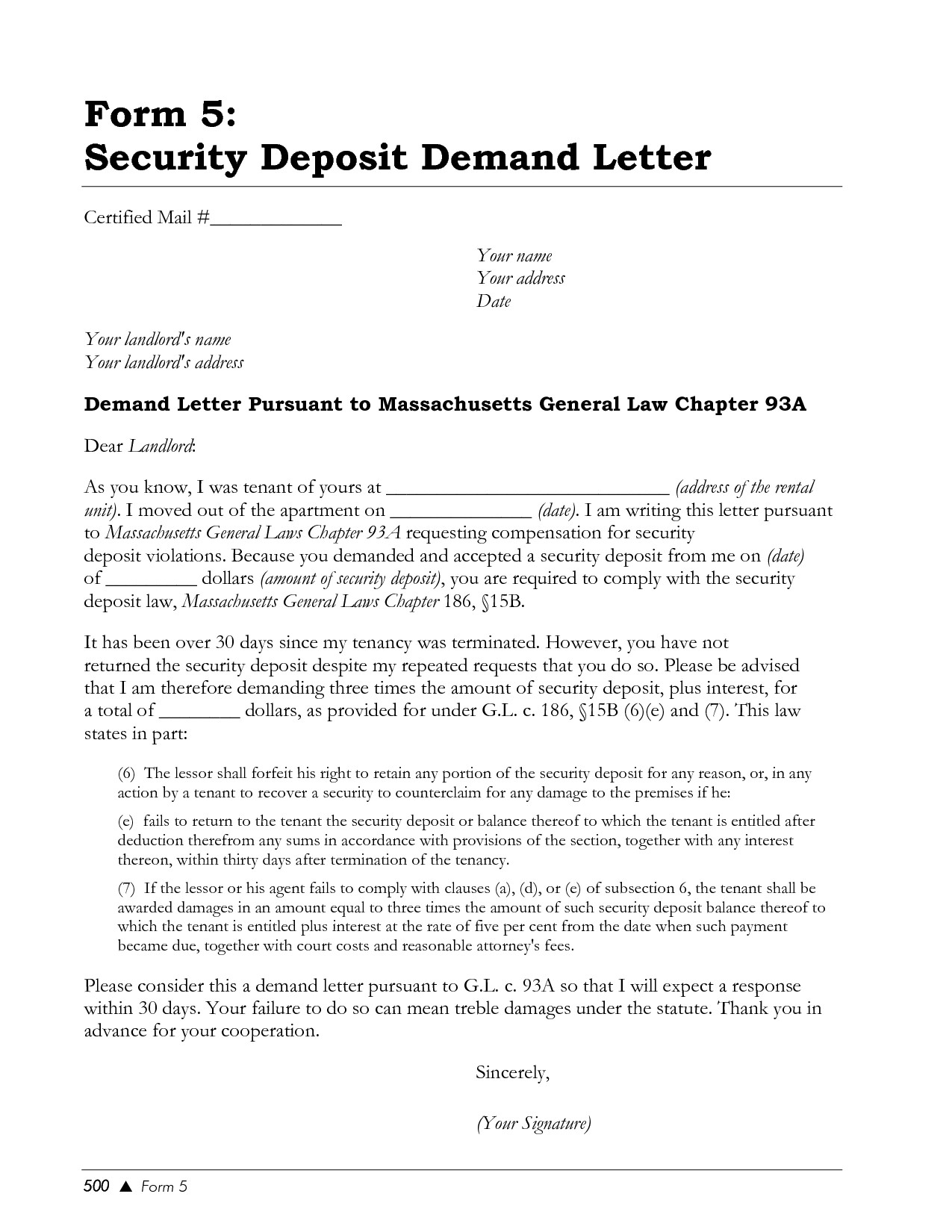

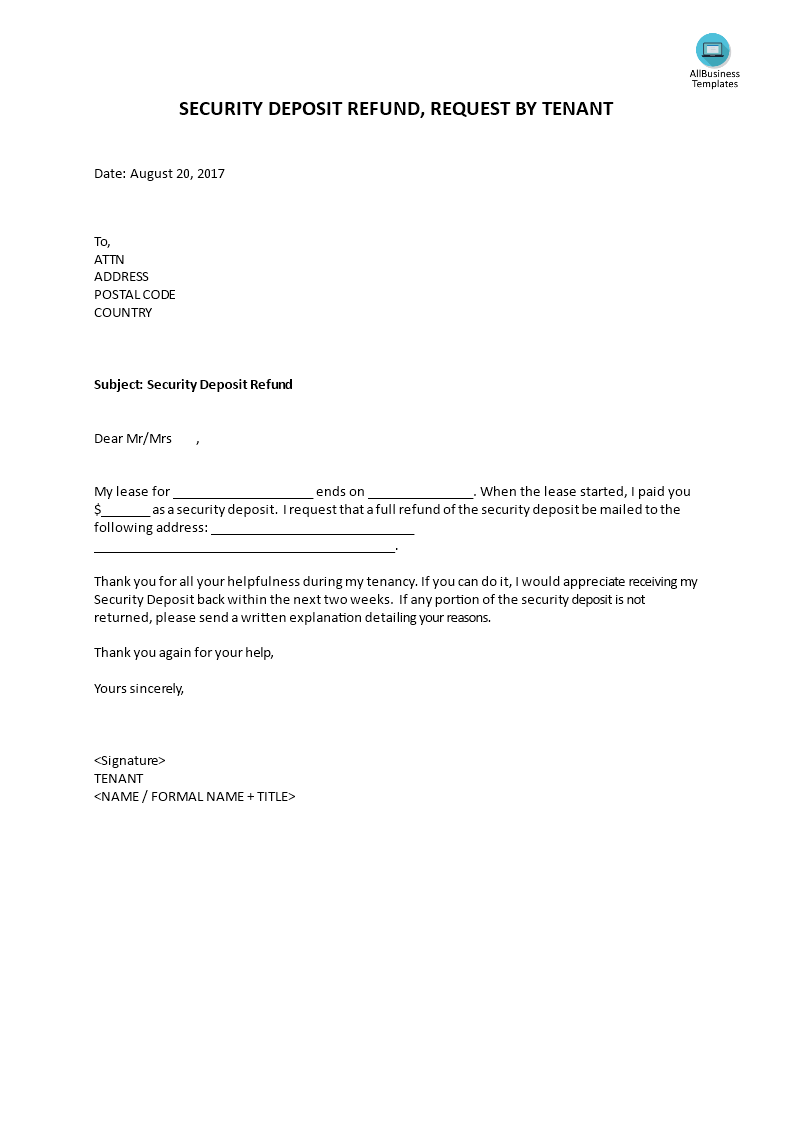

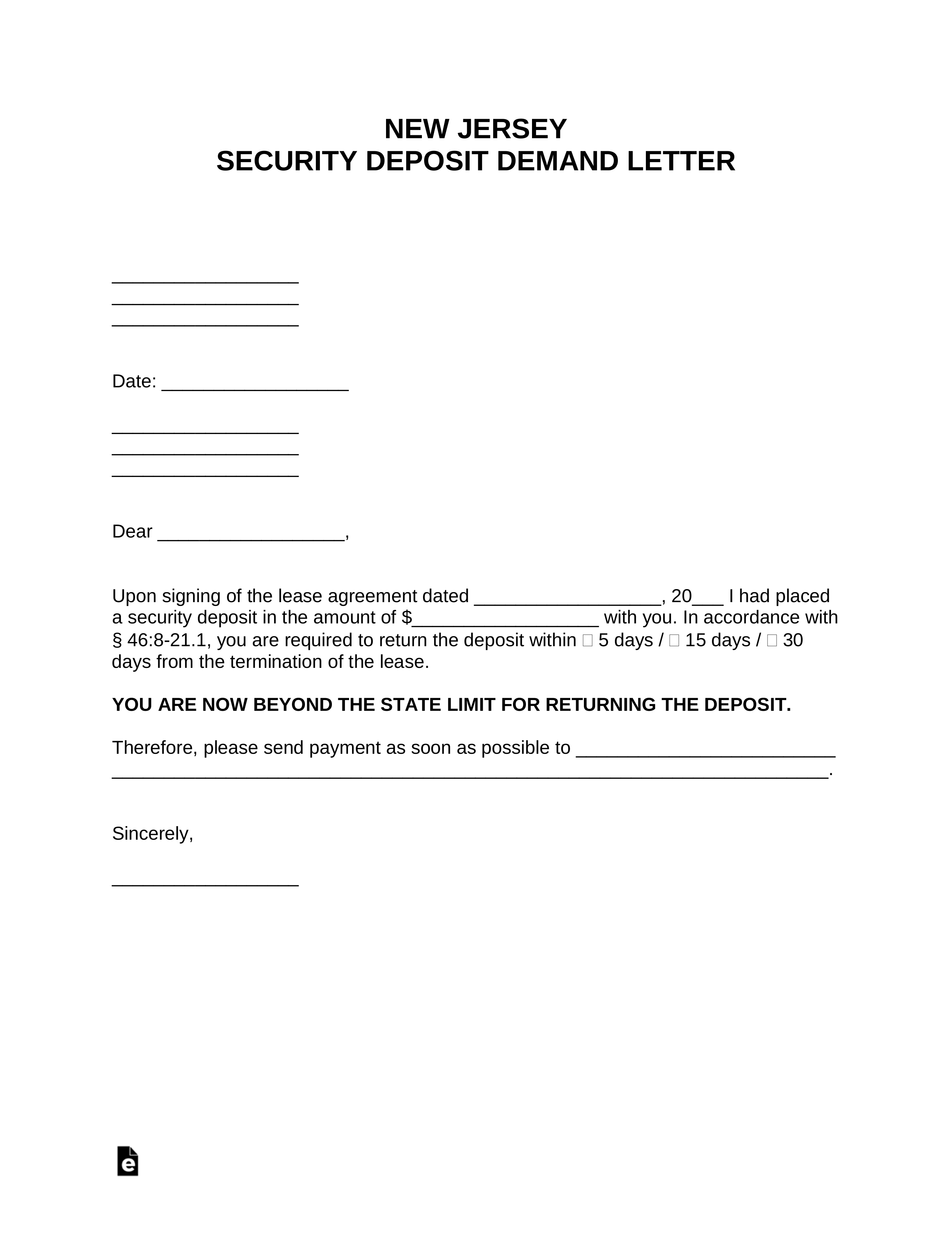

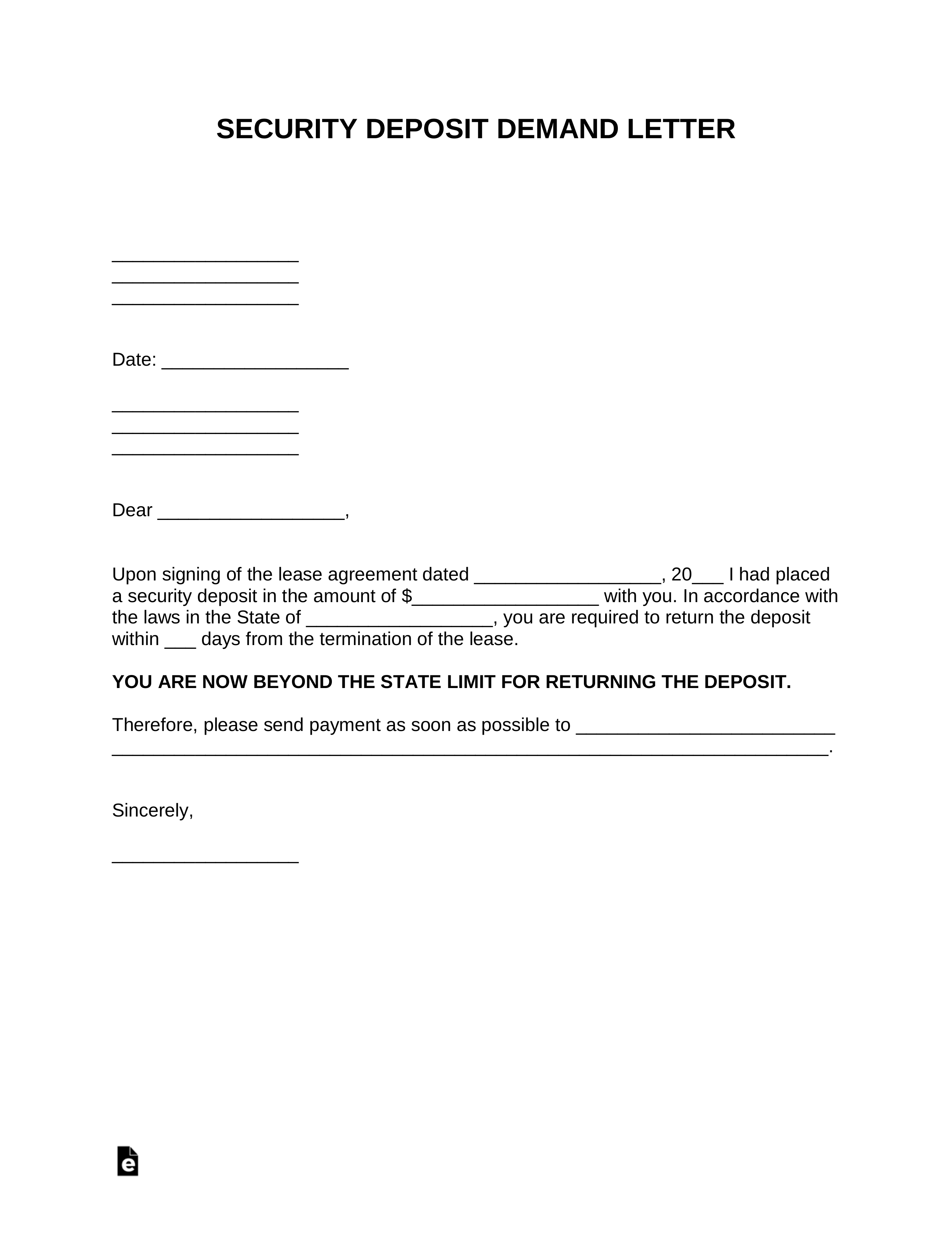

Security Deposit Demand Letter Template – Security Deposit Demand Letter Template

| Welcome in order to my weblog, with this moment We’ll teach you concerning Security Deposit Demand Letter Template

.

How about picture previously mentioned? is of which amazing???. if you feel thus, I’l t teach you a number of impression all over again beneath:

So, if you desire to obtain the amazing pics related to Security Deposit Demand Letter Template, just click save button to download the pics to your personal pc. They’re prepared for down load, if you want and wish to have it, click save logo on the web page, and it will be immediately saved in your desktop computer.} Finally if you need to obtain unique and the recent image related to Security Deposit Demand Letter Template, please follow us on google plus or save this website, we try our best to offer you daily up grade with all new and fresh pics. Hope you enjoy staying right here. For most up-dates and recent news about Security Deposit Demand Letter Template pictures, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We try to provide you with up grade periodically with fresh and new shots, enjoy your surfing, and find the right for you.

Thanks for visiting our site, articleabove Security Deposit Demand Letter Template published . Today we are delighted to declare we have found an awfullyinteresting contentto be pointed out, that is Security Deposit Demand Letter Template Most people searching for info aboutSecurity Deposit Demand Letter Template and of course one of them is you, is not it?

[ssba-buttons]