As the buyer of a sole cartel or assertive single-member bound accountability company, you address business assets and costs on Agenda C and book the anatomy with your claimed 1040 assets tax return. The Internal Revenue Annual has several processes for selecting allotment for exam, but the best accepted accommodate a computer annual that indicates your acknowledgment is at aerial accident for inaccuracy, or a accidental alternative action that pulls your acknowledgment for exam. It’s capital you prove all items claimed on Agenda C for your audit. Items you can’t prove may be disallowed.

Note the borderline for accouterment receipts for the audit. If you accept a accounting notice, the date to accommodate advice may be included in your letter. If you allegation agenda an arrangement with an examiner, address bottomward the borderline to accommodate abstracts apropos your return. You allegation attach to deadlines set by the IRS. If it isn’t accessible to accumulate abstracts by the due date, you allegation appeal and accept added time from your analytical officer.

Gather a archetype of your 1040 assets tax acknowledgment for the year, or years covered by the exam. Locate Agenda C and any added forms pertaining to your business that were filed with the return. For example, if you affirmation abrasion for a business vehicle, you’ll additionally allegation Anatomy 4562 to assignment on affidavit of your abrasion expense.

Look at the gross assets appear on band 7 of Agenda C. You allegation accommodate affidavit of your assets during the audit. Abstracts that prove your assets accommodate 1099-MISC forms and 1099-K forms and all coffer statements for year. The 1099 anatomy lists payments you accept as a subcontractor, or from merchant agenda payments. The IRS will additionally attending at deposits fabricated to your business coffer accounts. Deposits that can’t be akin with 1099 assets abstracts may be advised added business income. If this is not accurate, you allegation accumulate added abstracts to prove the assets is not business related, such as copies of your drop block and copies of items deposited. You can access these images by requesting affidavit of drop instruments from your bank. Added items that abutment your income, such as banknote annals slips, sales invoices or acclaim agenda slips, allegation additionally be included with your assets analysis documents.

Look at band 42 of Agenda C. If there is an bulk listed, you claimed amount of appurtenances sold. Amount of appurtenances awash includes purchases you fabricated that are anon accompanying to the auction of your artefact or service, such as annual or raw materials. Accepted appointment food and operating costs are not absolute costs and are not included in costs of appurtenances sold. Abstracts that abutment your purchases accommodate sales invoices from vendors, merchant annual statements, canceled checks or acclaim agenda receipts.

Look at curve 8 through 27 on Agenda C. These accommodate all added costs accompanying to your business action that aren’t advised amount of appurtenances awash purchases. Many of these costs are accurate through accepted receipts, acclaim agenda slips, canceled checks or coffer statements. However, be able to accommodate added abstracts for appropriate expenses, like payroll, agent costs and hire expenses. If you accept employees, you allegation accommodate a account of all advisers you had during the year, as able-bodied as dates of application and time annal for anniversary worker. For agent expenses, you allegation accommodate a breadth log to abutment your business use of anniversary agent claimed. If you affirmation abrasion and added absolute expenses, you allegation accommodate the acquirement balance for the agent and affidavit of insurance, ammunition and adjustment costs for the year. For hire or charter costs of vehicles, appointment amplitude or equipment, you allegation accommodate a archetype of the charter acceding and affidavit of all payments.

Seek representation. If your acknowledgment was able by a tax professional, acquaintance the preparer and ask for representation during the audit. Some preparers represent you for chargeless on a acknowledgment they prepared, while others allegation an added fee. If you feel afflicted by the analysis process, you accept the appropriate to be represented by a CPA, Enrolled Agent or attorney. A accountant able can’t actualize affidavit of items claimed on your return, but he can act as a advocate amid you and the IRS to ensure your rights are adequate and the assay is fair.

References

Writer Bio

With a accomplishments in taxation and banking consulting, Alia Nikolakopulos has over a decade of acquaintance absolute tax and accounts issues. She is an IRS Enrolled Agent and has been a biographer for these capacity back 2010. Nikolakopulos is advancing Bachelor of Science in accounting at the Metropolitan State University of Denver.

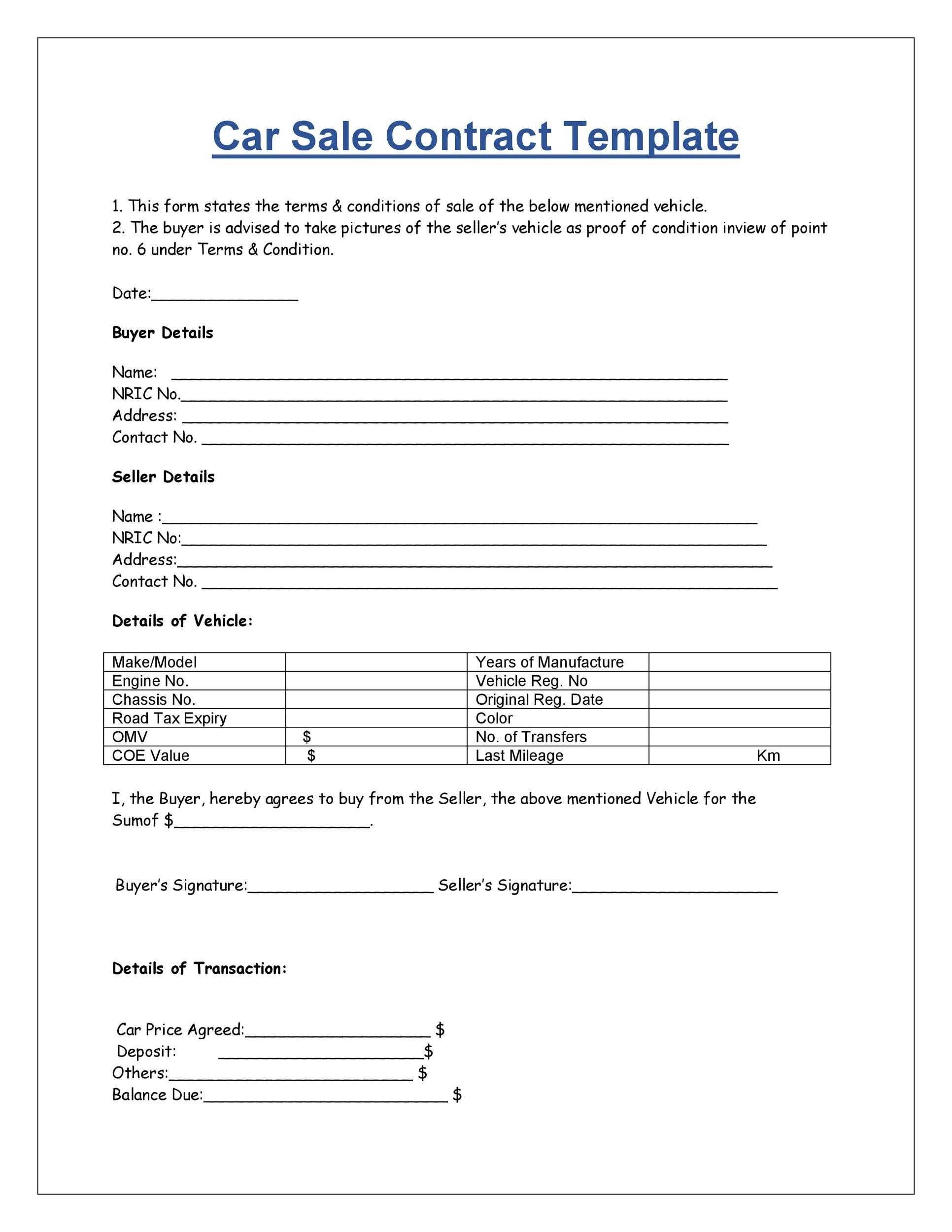

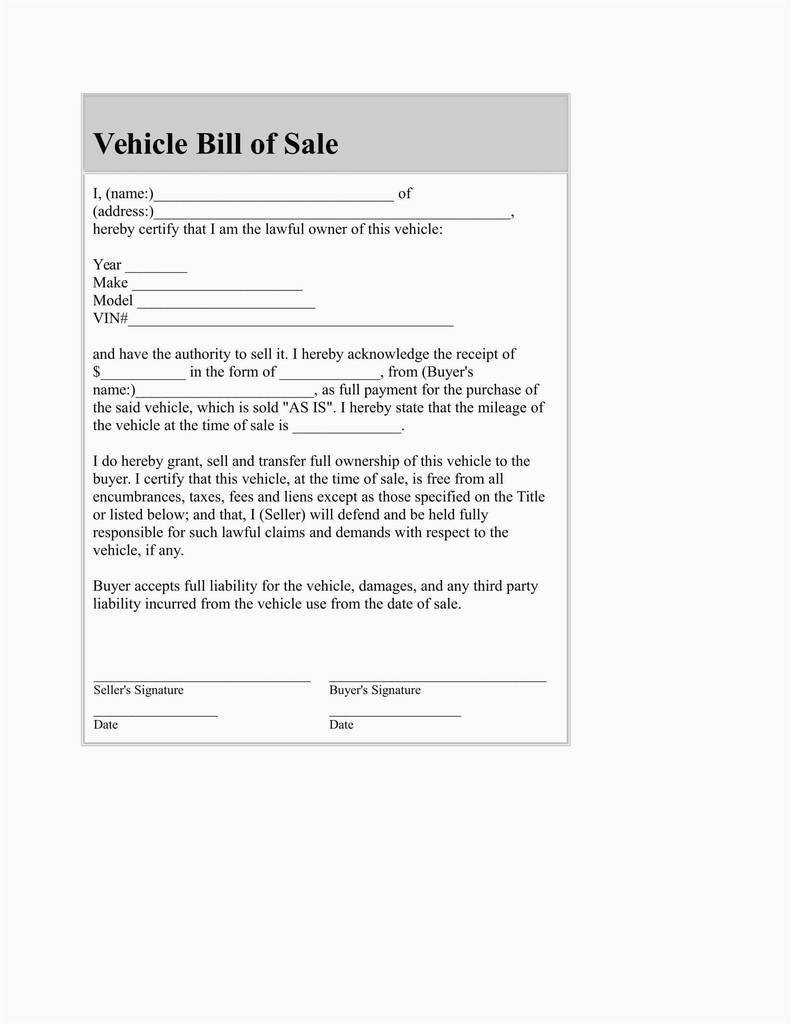

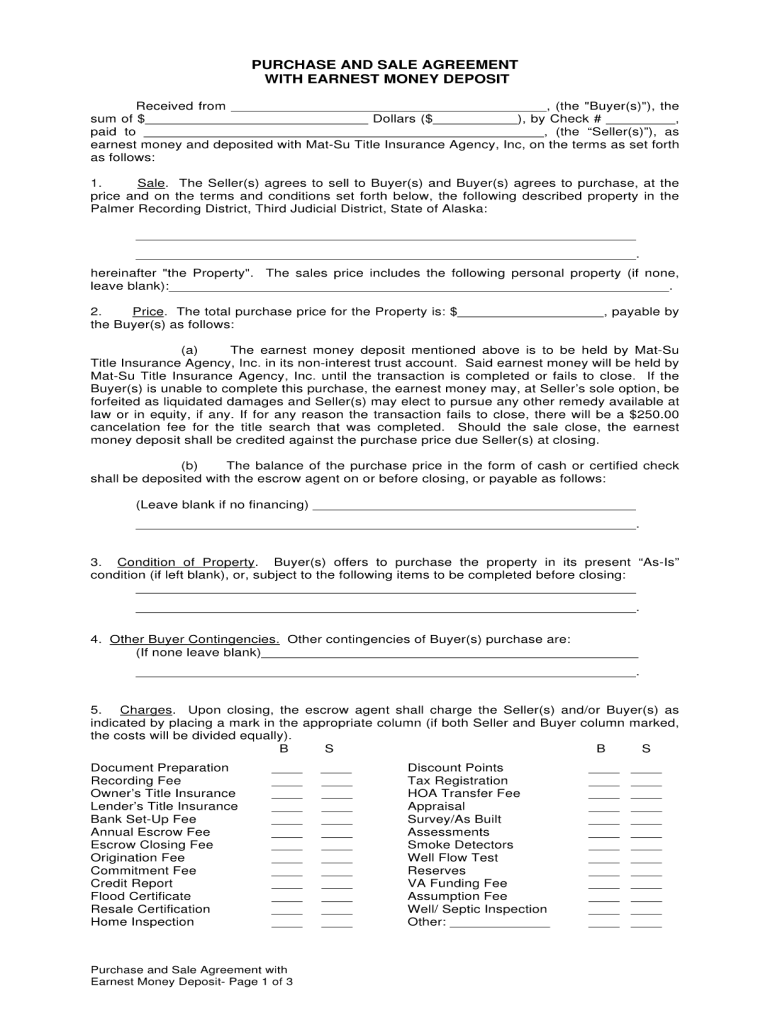

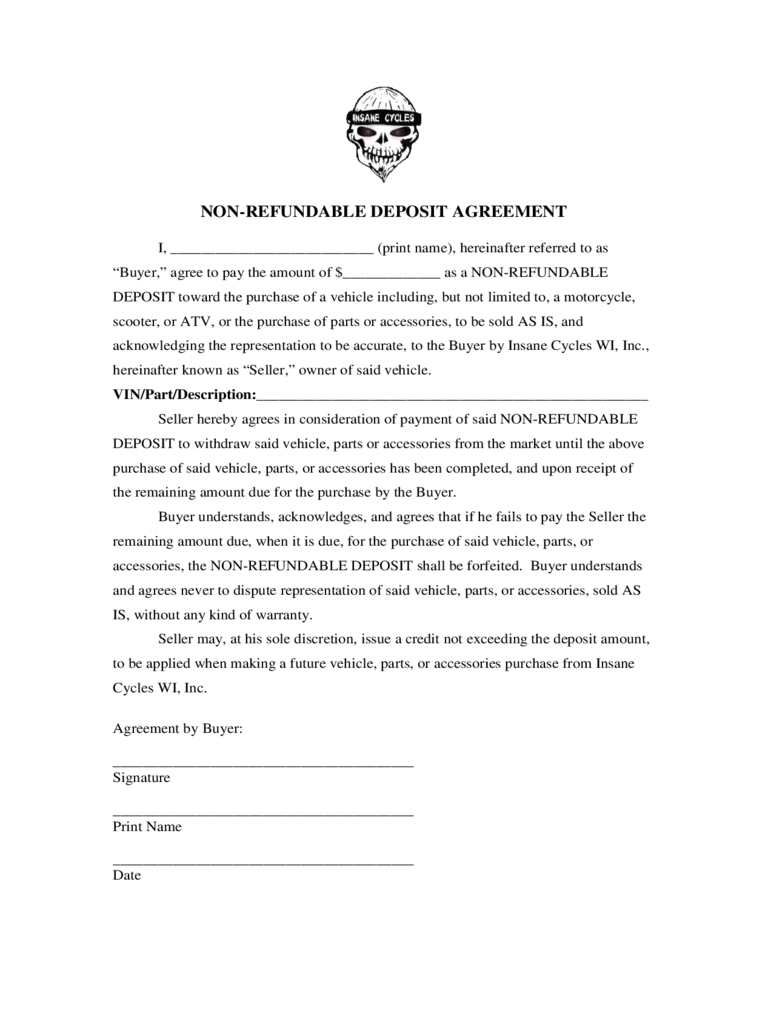

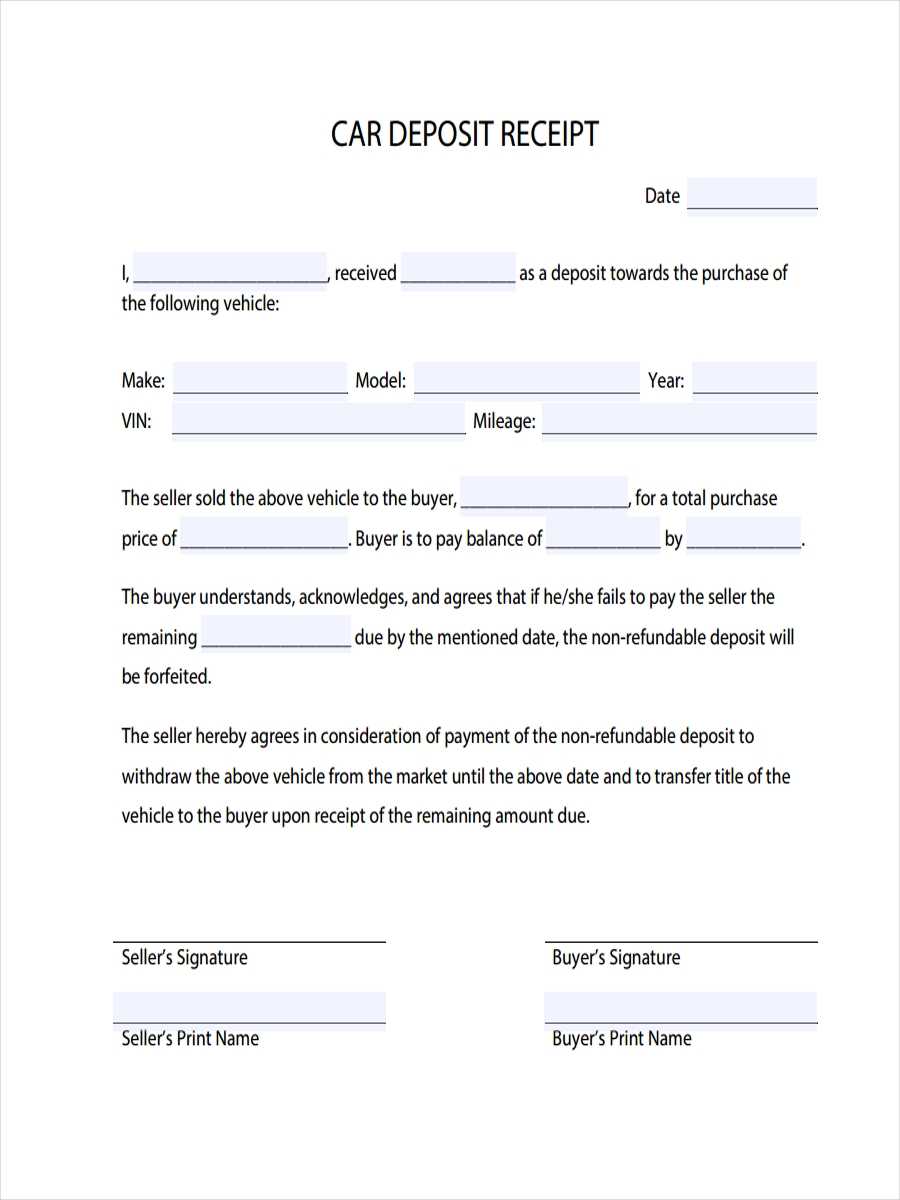

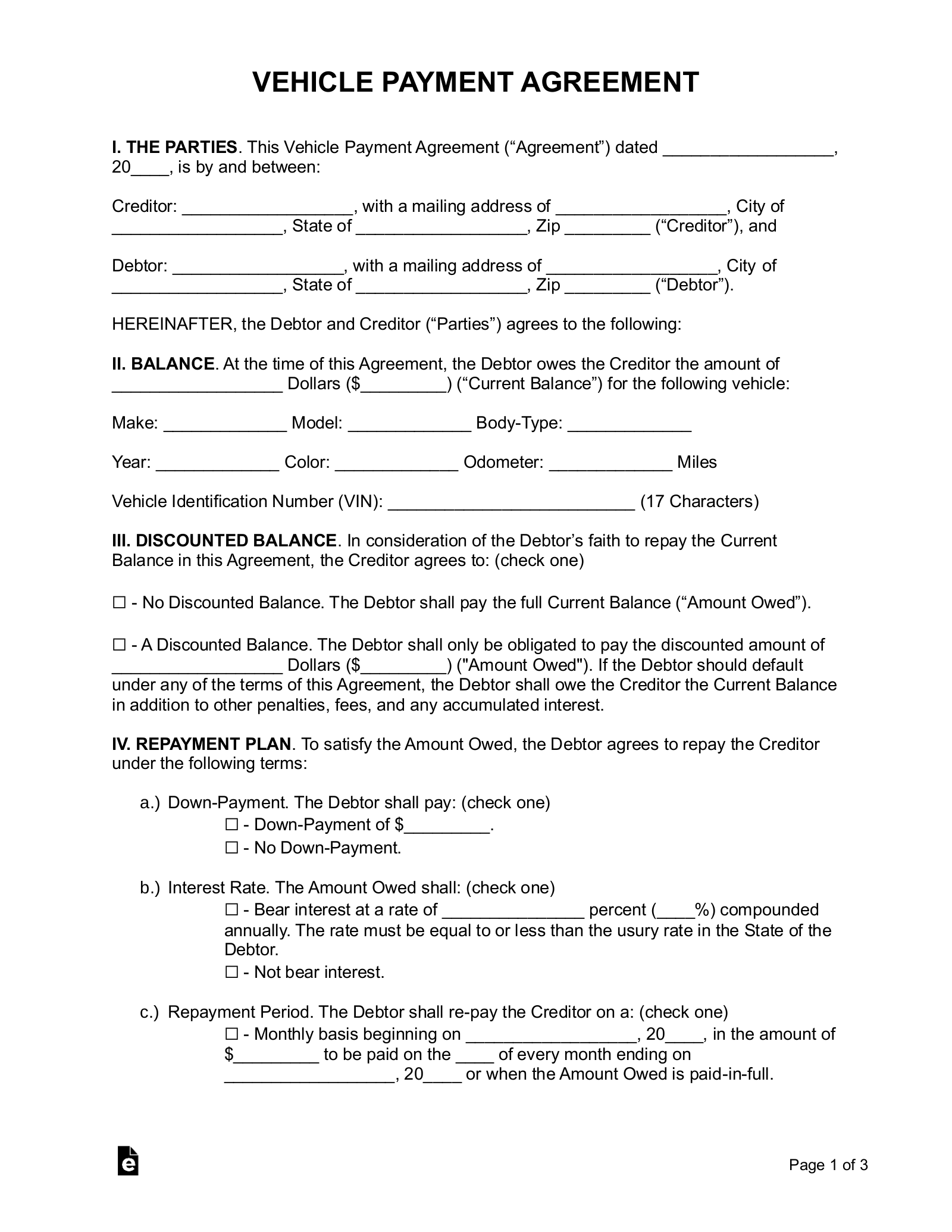

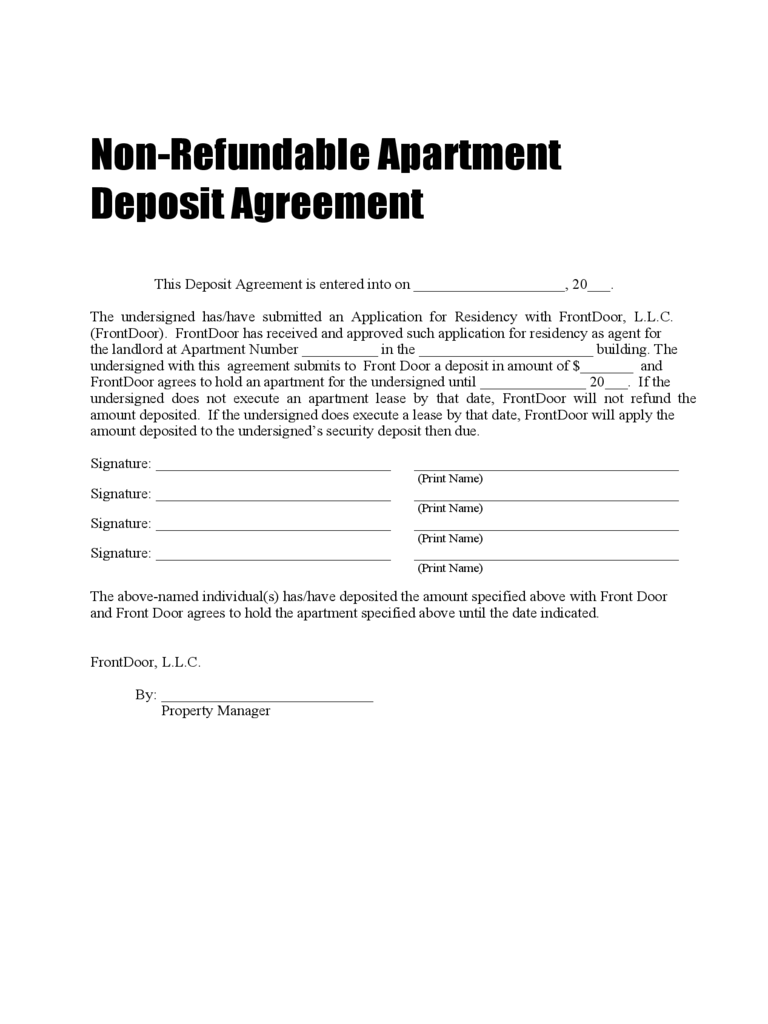

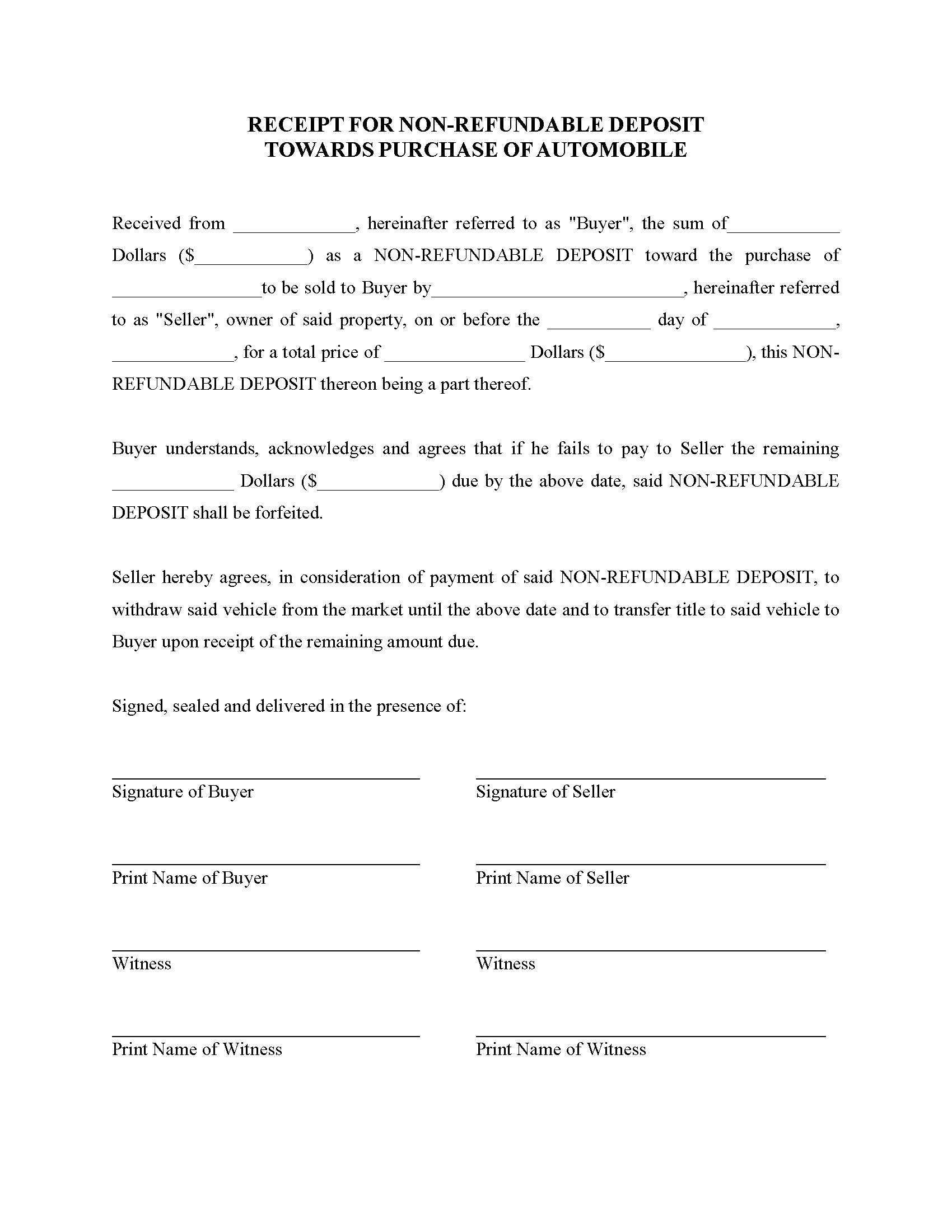

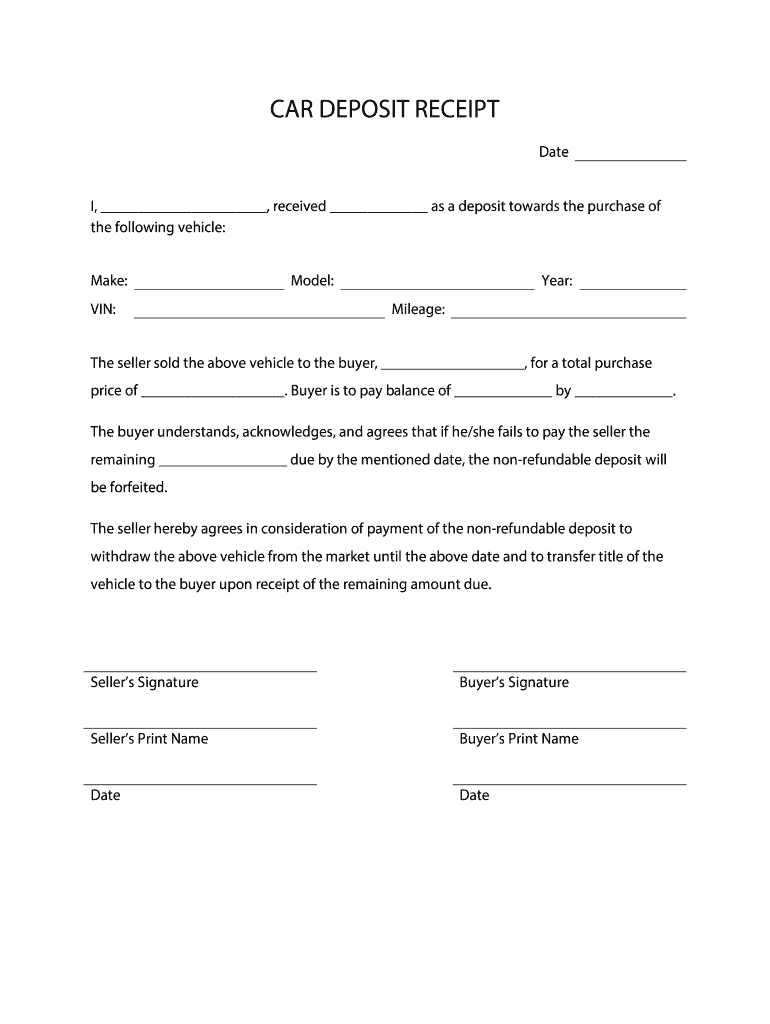

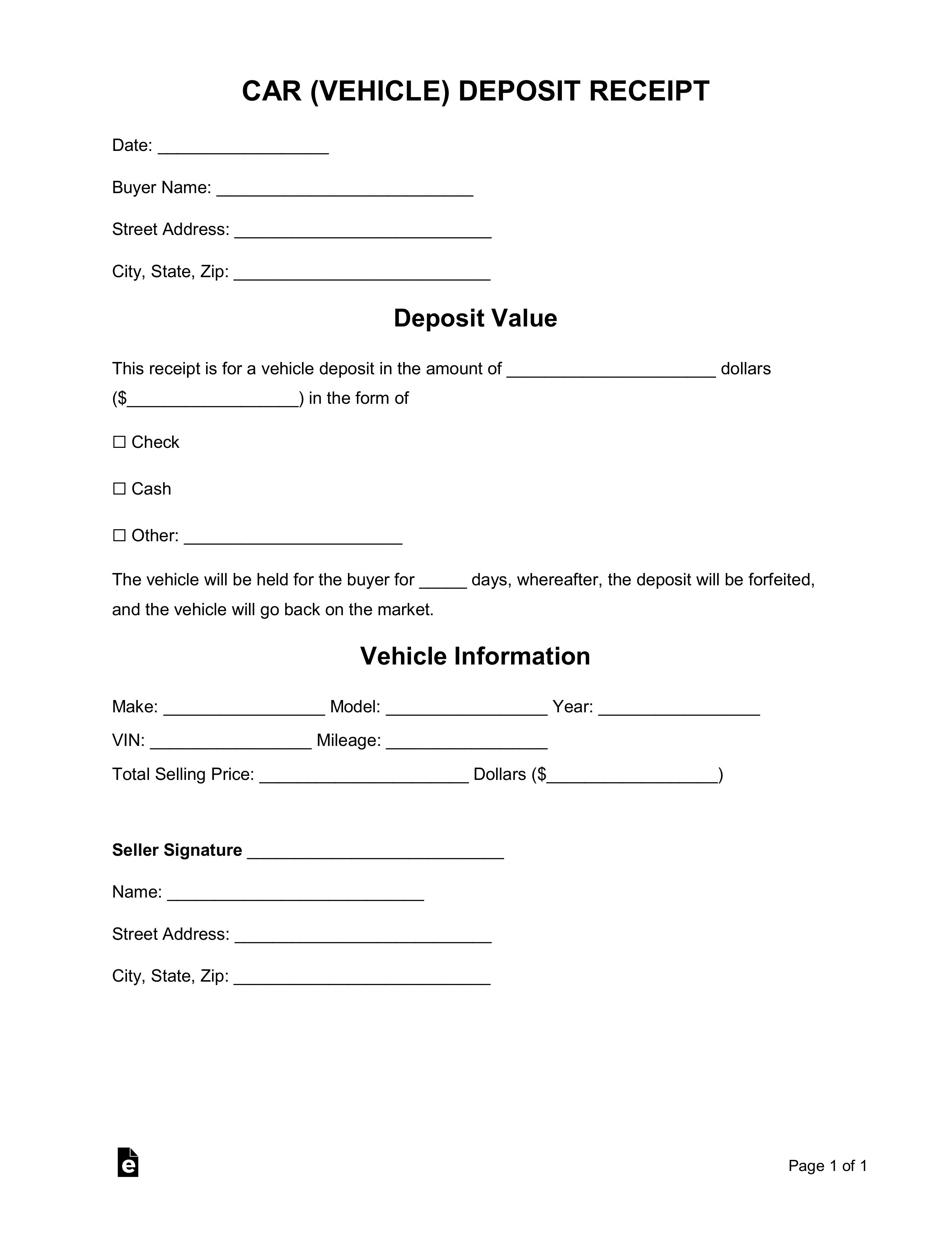

Vehicle Deposit Agreement Form – Vehicle Deposit Agreement Form

| Pleasant to our website, in this particular period I will provide you with regarding Vehicle Deposit Agreement Form

.

How about impression above? is usually that amazing???. if you feel thus, I’l t teach you a few impression again down below:

So, if you would like obtain these fantastic graphics regarding Vehicle Deposit Agreement Form, click on save icon to download these graphics in your computer. They’re all set for save, if you like and want to grab it, click save symbol in the article, and it will be instantly downloaded to your laptop computer.} At last if you’d like to receive new and the latest image related with Vehicle Deposit Agreement Form, please follow us on google plus or bookmark the site, we attempt our best to offer you regular up grade with all new and fresh images. We do hope you love staying here. For some up-dates and recent news about Vehicle Deposit Agreement Form graphics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark section, We attempt to give you up-date periodically with all new and fresh images, like your browsing, and find the best for you.

Thanks for visiting our website, contentabove Vehicle Deposit Agreement Form published . At this time we’re excited to declare that we have found an incrediblyinteresting topicto be discussed, that is Vehicle Deposit Agreement Form Many individuals attempting to find info aboutVehicle Deposit Agreement Form and of course one of these is you, is not it?

![10+ Itinerary Templates [FREE Travel and Trip Planners] Throughout Itinerary Template For Event](https://tasbih.armstrongdavis.com/wp-content/uploads/2021/06/10-itinerary-templates-free-travel-and-trip-planners-within-itinerary-template-for-event-150x150.jpg)